Risk Management, Resiliency, and Relationships

by Tara L. Humston, Senior Vice President, Division of Supervision and Risk Management, Federal Reserve Bank of Kansas City

The final quarter of 2023 is an opportune time to reflect on a challenging year in which the banking industry has witnessed quickly rising interest rates, historic liquidity runs, and three regional bank failures with contagion to other banks.

Local, national, and international banking conditions continue to evolve, and challenges in the banking industry will likely continue to manifest in unpredictable ways influenced by economic factors and broad trends, such as the evolution of technology. Changing conditions through economic cycles impact individual banks differently depending on their business lines, risk profiles, and markets, as well as their preparedness and ability to manage risks. Through these economic cycles and structural industry changes, the Federal Reserve’s supervisory approach will continue to be grounded in long-standing safety and soundness principles that are commensurate with the risks. However, as Federal Reserve Vice Chair for Supervision Michael Barr noted regarding the supervision and regulation of Silicon Valley Bank, we have learned from the current cycle that we have an opportunity to adjust the speed, force, and agility of bank supervision when banking conditions and the risk profiles of banking institutions are changing quickly.1 We can’t prevent stresses from occurring; we can, however, establish plans, processes, and working relationships to strengthen the resiliency of the U.S. banking system and our ability as supervisors to quickly respond to the evolving risk profiles of banks.

While times of crisis and financial stress have taught me many important lessons as a bank supervisor, three key safety and soundness themes remain particularly relevant for bank management and bank supervisors as we navigate changing conditions and a changing industry: (1) robust risk management frameworks; (2) business resiliency, including capital, liquidity, and operational resiliency; and (3) collaborative relationships with two-way communication between bankers and bank supervisors. To illustrate these points, I will highlight key examples of historical changes in banking conditions and trends and the importance of maintaining foundational principles applicable to a variety of risk scenarios.

Changing Conditions and a Changing Industry

The Great Recession (2007–2009) and the recent pandemic illustrate two notable shifts in economic conditions, or broader industry structural changes, that resulted in significant challenges for banks and bank supervisors.

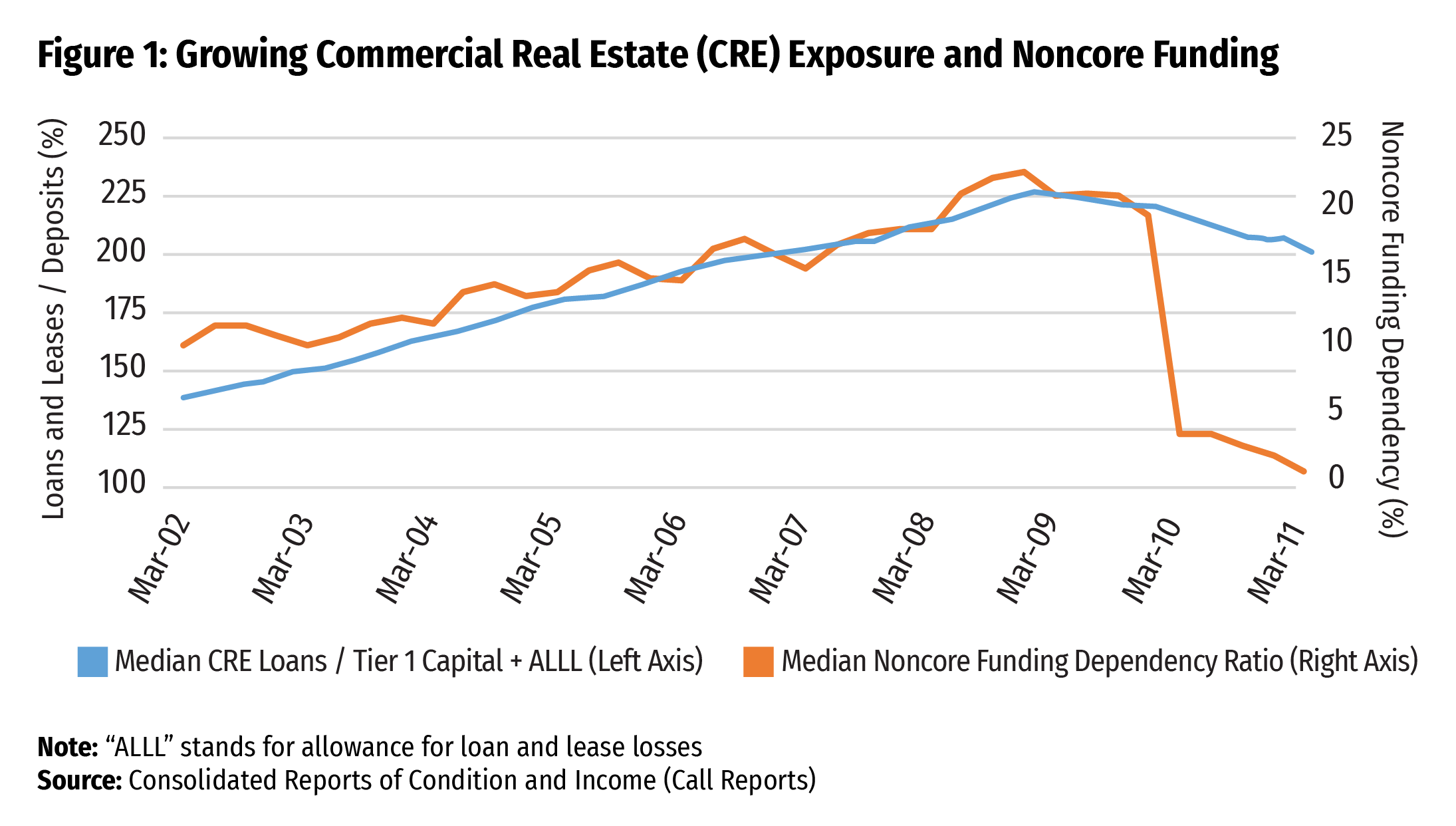

During the Great Recession, we saw how heightened risk in multiple areas (risk layering) increased a bank’s vulnerability to economic stress. Specifically, credit risk increased substantially when rapid growth, often funded by volatile funding sources, led to excessive concentrations without commensurately strong risk management practices (see Figure 1). To mitigate these risks across multiple areas, the supervisory focus shifted from specific individual risks, such as credit concentrations, to a more comprehensive view, with supervisors considering the layering and interconnectedness of risks along with an assessment of banks’ contingency plans. The Great Recession highlighted the value of banks establishing a strong risk management framework and of supervisors assessing a bank’s risk management framework in advance of the bank building an asset or liability concentration and before a potential economic downturn.

The pandemic brought another set of challenges for the banking industry. Operational resiliency was required as physical operations, cash and coin availability, and staffing were impacted while economic activity slowed. The pandemic further accelerated longer-term structural trends that were already underway, such as changes in how and where people work and the increased reliance on virtual communications and electronic data across all industries. Pandemic preparedness and contingency planning were vital for both banks and bank supervisors.

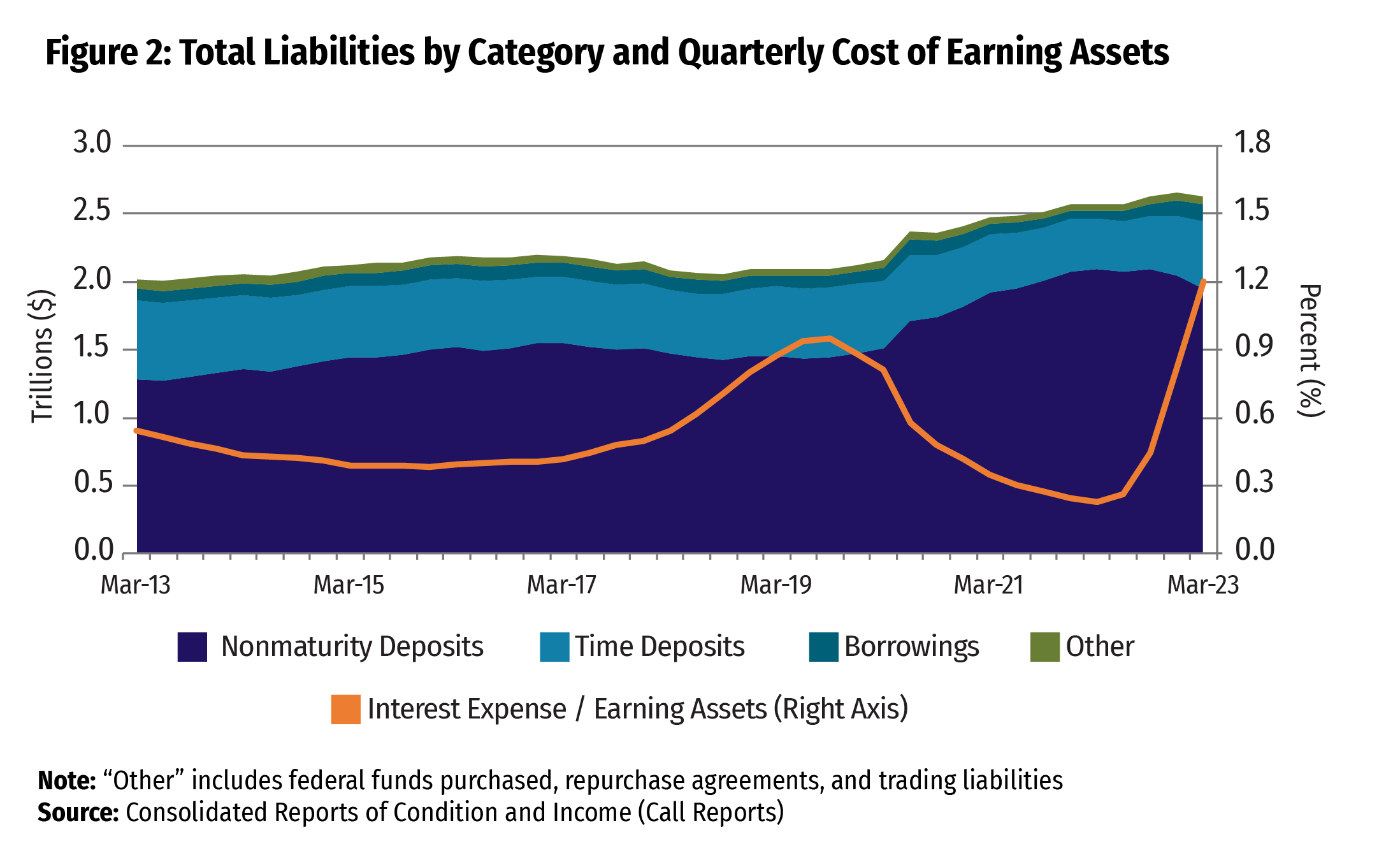

However, as some of the direct risks stemming from the pandemic subsided, inflationary pressures and subsequent interest rate increases began to have prominent implications for banks. Following the outset of the interest rate increases in 2022, investment portfolio values declined after sizable growth in 2020 and 2021. This resulted in some banks with large unrealized loss positions; for these banks, selling securities for liquidity could prove too costly, potentially forcing them to rely on cash and reserves or borrowings to meet funding needs. Furthermore, banks with elevated levels of unrealized loss are also at risk of losing critical funding sources such as Federal Home Loan Bank borrowings.2 These challenges, along with deposit competition and changes in liability mix, have led to tightening liquidity profiles (see Figure 2).

Since the pandemic, loan growth has spiked, and loans to assets are approaching pre-pandemic levels for community and regional banks (see Figure 3). Although credit quality generally remains sound across community banks, nationwide delinquencies are increasing in consumer credit. Credit card delinquencies spiked prior to the resumption of student loan payments.3 Commercial mortgage-backed securities delinquencies have also increased. The potential for an economic slowdown and the higher debt service requirements at loan renewals create headwinds for credit quality and heighten the importance of sound credit risk management.

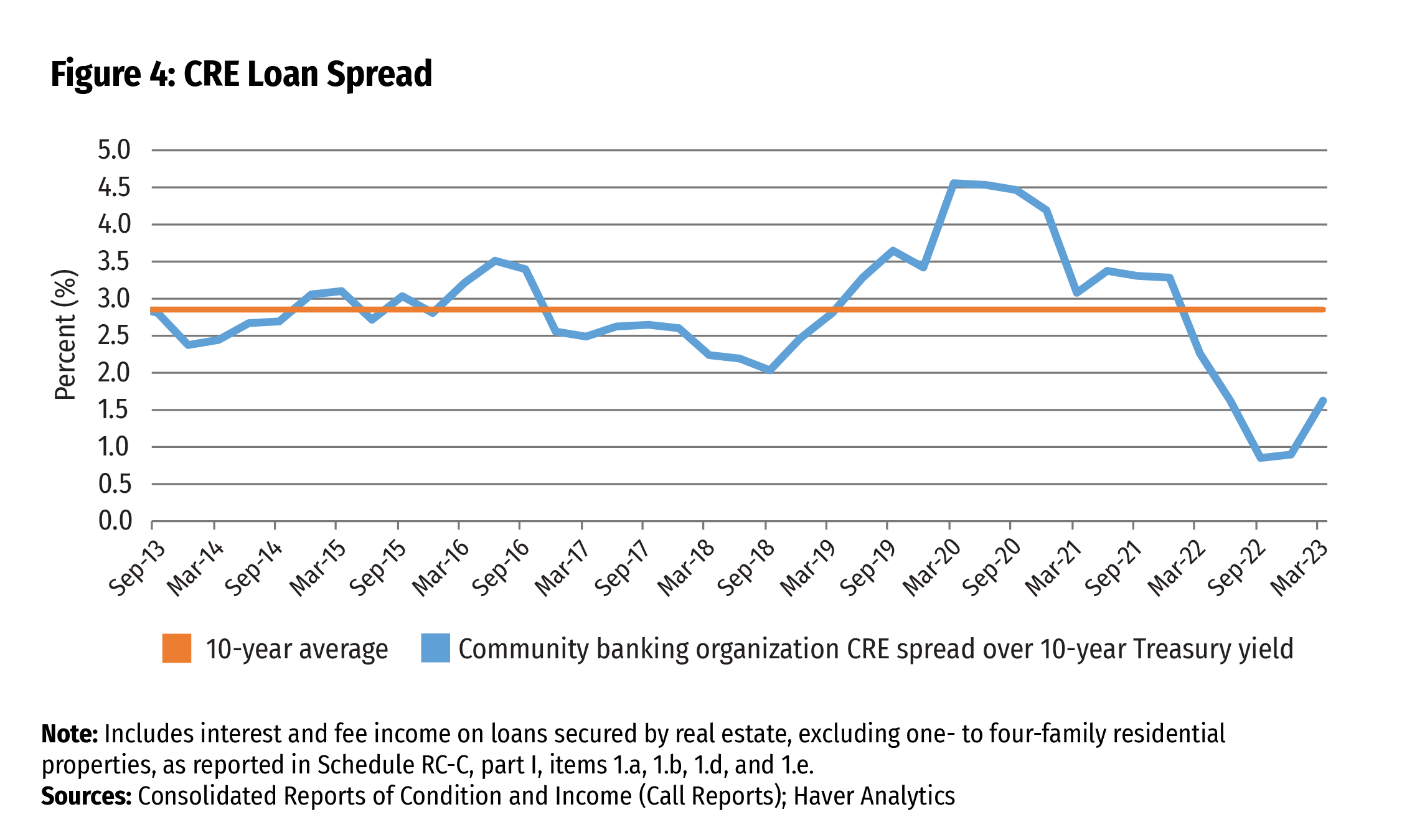

As illustrated in the June 1, 2023, Community Banking Bulletin from the Federal Reserve Bank of Kansas City, the lag in commercial real estate (CRE) loan repricing has reduced the risk premium for CRE loans; at the same time, rising interest rates and higher overhead expenses are increasing pressure on the cash flows of CRE borrowers (see Figure 4).4 This may be a precursor of deteriorating asset quality; therefore, banks and bank supervisors should be prepared to react appropriately to promptly identify and mitigate risks.

Along with these increasing risks, 10th District community bank examinations in 2023 have noted more issues that are symptoms of the significant overall growth that occurred in 2021 and 2022. These issues include inadequate staffing; waning risk management practices, such as failing to collect appropriate information to analyze credits on an ongoing basis; outdated contingency funding plans that do not address the currently tighter liquidity environment; outdated nonmaturity deposit assumptions in interest rate risk models; and lower capital and liquidity cushions relative to banks’ increased risk profiles. In aggregate, community banks’ risk-based capital ratios and liquid asset cushions have continued to shrink while risk profiles have increased.

Key Safety and Soundness Themes

Experiences during prior economic cycles and the current one provide key insights for responding to changes in economic conditions and the banking industry.

Pre-Emptive and Adaptive Risk Management

As risks and risk layering become more prominent at banks, stronger risk management becomes necessary. For example, deteriorating market risk could impact liquidity risk and could therefore merit enhanced risk management in both areas as well as greater capital resiliency. A key point is that banks’ risk management programs need to be fortified before risk manifests or ahead of the launch of a new product or initiative. Further, risk management programs need to be revisited more frequently when conditions are changing or when new products or initiatives are being implemented.

In addition, as banks embark on strategic growth initiatives, supervisory expectations for risk management will also increase. We know from our experiences that banks with proactive and adaptable risk management programs tend to fare better through periods of changing economic conditions. Likewise, banks that have instituted or upgraded risk management programs ahead of launching new products or initiatives are better positioned to face the unforeseen challenges of implementation that inevitably occur. I have continued to see these themes play out this year with banks conducting both traditional and novel banking activities.

Contingency Planning

Both historical and recent events illustrate the importance of forward-looking risk management through contingency planning. Each of the examples stated previously highlights that, as conditions change, it is critical for a bank to identify potential vulnerabilities and to be prepared with specific steps to take if an identified risk exceeds tolerances. A detailed contingency plan can help a bank identify triggers for action and plan the sequence of steps to be implemented in a time of heightened risk. Effective contingency plans improve capital and liquidity resiliency, which can serve as a backstop to calculated risk-taking and can cushion banks from uncertainties during a down cycle. As highlighted broadly during the pandemic and also in more isolated operational disruptions such as natural disasters or cyberattacks, banks that develop and maintain strong plans for operational resiliency are better able to limit the downside of acute operational challenges.

Recent liquidity runs underscore the importance of liquidity resiliency and contingency planning, as technology can increase a bank’s vulnerability to virtually interconnected depositors who may react similarly under stress. The bank regulatory agencies responded by updating the Interagency Policy Statement on Funding and Liquidity Risk Management to point out the importance of banks being operationally ready to access contingent funding sources — including the discount window — by signing up, pre-positioning collateral, and periodically testing the borrowing arrangement.5 We have also seen how reputational risk from social media and other media platforms can exacerbate a bank’s liquidity risk. Comprehensive contingency funding plans should provide risk mitigation steps, including communication plans to address media and social media responses, depending on the circumstances.

Similarly, capital planning has proved valuable in mitigating the financial distress precipitated by unforeseen events. Regardless of the stage of economic cycles, examiners will continue to evaluate the sufficiency of capital in relation to the risk profile of a banking institution and the effectiveness of its capital planning process. Effective capital plans identify triggers for action and sources of capital to be used if ratios decline or risks become more severe relative to capital. In my experience, community banking institutions that take a comprehensive and proactive approach to ensuring resiliency are best positioned for long-term success.

Communication During Times of Change

The Federal Reserve values banker perspectives, opinions, and relationships at all times and especially when conditions in the industry are changing quickly. Just as supervisory programs and processes have evolved, the relationship between bankers and bank supervisors has also evolved. A few decades ago, crews of bank examiners arrived for examinations unannounced. There was no opportunity for bankers to prepare. Bank staff schedules were interrupted, and documents and files were requested on the spot. The relationship between bankers and supervisors was understandably contentious at times. However, our experiences have changed how we examine banks, and we seek an approach that minimizes supervisory burden while maintaining an ongoing, two-way dialogue focused on changing risks and risk mitigation.

Engagement between bankers and supervisors is critical to the functioning of the Federal Reserve supervision program. An open dialogue can directly benefit bankers in several ways. Conversations between bankers and bank supervisors create opportunities for the Federal Reserve to provide resources to community banks, such as current expected credit loss (CECL) tools6 and outreach information on topics of the most interest to bankers.7 Furthermore, supervisors benefit from open discussions with bankers about their views on emerging risks and market conditions and can, in turn, share what they have learned with other bankers who are facing similar challenges. Moreover, a discussion with an examiner early in the process of addressing a challenge or launching a new strategic initiative may help a banker avoid pitfalls that have already been addressed by another bank.

Open communication channels between bankers and examiners outside of the supervisory process equip Reserve Bank staff with important information about regional economic conditions. Furthermore, this dialogue can have potential implications for policy and supervisory posture that may need to be adapted to address changing conditions. While each Federal Reserve Bank has a regional perspective based on the institutions within its District, the information bankers share helps inform the perspective of the Federal Reserve System, as the heads of community bank supervision from each Reserve Bank and leaders from the Board of Governors meet regularly to discuss the issues impacting community bank supervision. Another example of a formal communication mechanism to ensure that banker perspectives from each Federal Reserve District are conveyed to the Board is the Community Depository Institutions Advisory Council (CDIAC).8 Banker representatives from each Federal Reserve District meet semiannually with the Board to discuss important matters impacting community depository institutions. These opportunities to hear directly from community bankers will remain an essential input into the foundation of the Federal Reserve’s community bank supervision program.

Conclusion

Changes in economic cycles and advances in technology (e.g., digital assets, machine learning, and artificial intelligence) may change the way banks deliver services to their customers and may also change how institutions are supervised. But these trends are not likely to change the fundamentals of safe and sound banking or the importance of strong working relationships and communication between banks and supervisory agencies. Strong relationships and open, two-way communication between bankers and supervisors increase the opportunities to foster resiliency and mitigate risks before problems arise.

If you have questions or would like to discuss business strategies, plans, or other areas that could impact your institution’s risk profile or the Federal Reserve’s supervisory approach for your institution, your local central point of contact or Federal Reserve Bank management team welcomes the conversation. We hope to hear from you and will work with you to promote healthy and sound practices.

- 1 For more information, see Vice Chair Barr’s review of the supervision and regulation of Silicon Valley Bank, available at www.federalreserve.gov/publications/files/svb-review-20230428.pdf.

- 2 For more information, see 12 C.F.R. part 1266.4, available at www.ecfr.gov/current/title-12/chapter-XII/subchapter-D/part-1266/subpart-A#1266.4.

- 3 The U.S. Department of Education provided COVID-19 relief for federal student loans; these borrowers were eligible for an automatic pause on their loan payments, with the interest rate set to 0 percent, from March 13, 2020, until September 1, 2023. Payments resumed in October 2023. More information is available at https://studentaid.gov/announcements-events/covid-19.

- 4 See “Highlight: Risk Premium for CRE Lending Has Declined,” available at www.kansascityfed.org/banking/community-banking-bulletins/risk-premium-for-cre-lending-has-declined.

- 5 The joint press release regarding the update is available at www.federalreserve.gov/newsevents/pressreleases/bcreg20230728a.htm.

- 6 Information on the Scaled CECL Allowance for Losses Estimator (SCALE) and Expected Loss Estimator (ELE) tools can be found in the CECL Resource Center, available at www.supervisionoutreach.org/cecl.

- 7 Ask the Fed, a program covering the latest financial and regulatory developments for bankers, is available at https://bsr.stlouisfed.org/askthefed.

- 8 More information about CDIAC can be found at www.federalreserve.gov/aboutthefed/cdiac.htm.