Capital Trends Since the Pandemic and the Ongoing Importance of Prudent Capital Planning

by Kerri Koral, SRM Manager, Examinations & Inspections, Federal Reserve Bank of Kansas City, and Sabrina Pellerin, Senior Risk Specialist, Surveillance & Risk Analysis, Federal Reserve Bank of Kansas City

Through years of experience and having weathered prior storms, seasoned bankers are keenly aware of the importance of holding sufficient capital to support the overall risk profiles and operations of banks. The current economic environment is yet another reminder that prudent capital planning is a critical element of overall bank strategic planning. Regardless of the economic climate, capital planning should always be conducted after the careful analysis of a bank’s risk profile, including the consideration of multiple risks occurring simultaneously, that is, risk layering. Banks are experiencing the resulting impacts of rising interest rates in multiple ways, including deposit runoff, loan and deposit competition, liquidity crunches driven by deposit declines, unrealized losses and other factors, and reductions to tangible capital because of unrealized losses.

In 2013, Community Banking Connections published an article outlining the importance of ensuring capital adequacy through effective planning, not only in troubled times but also when conditions are favorable and banks are well positioned to plan and prepare for adverse circumstances.1 Seven years later — during the height of the COVID-19 pandemic — another article was published that revisited the key principles of effective capital planning, including the assignment of the capital ratings component.2

Given the ongoing importance of diligent capital planning and in light of the current interest rate environment, this article highlights many of the current challenges that lead to increased risk and underscore the importance of dynamic capital planning. It also serves to refresh the key principles that support effective capital planning risk management.

Balance Sheet and Capital Trends Since the Pandemic

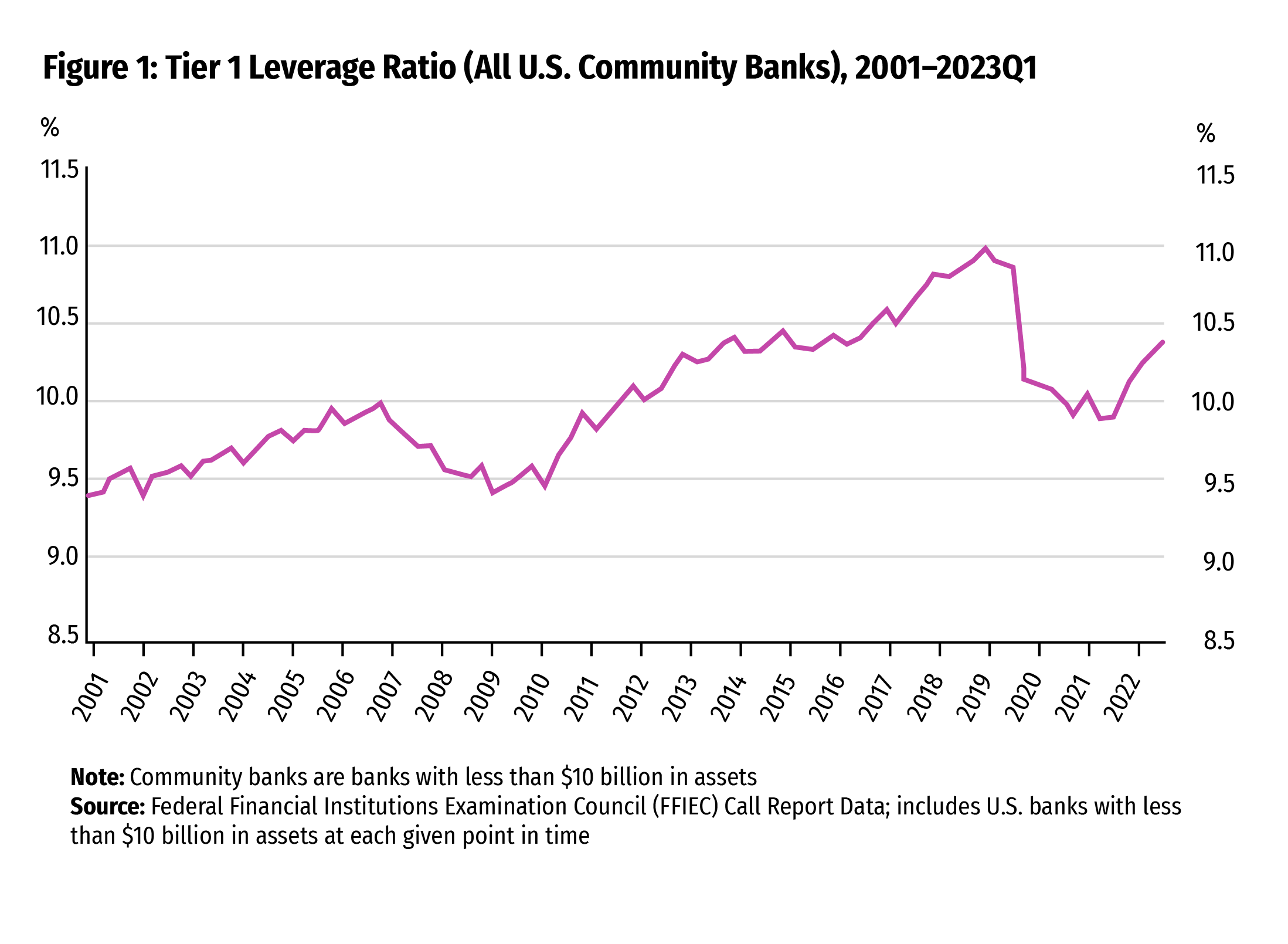

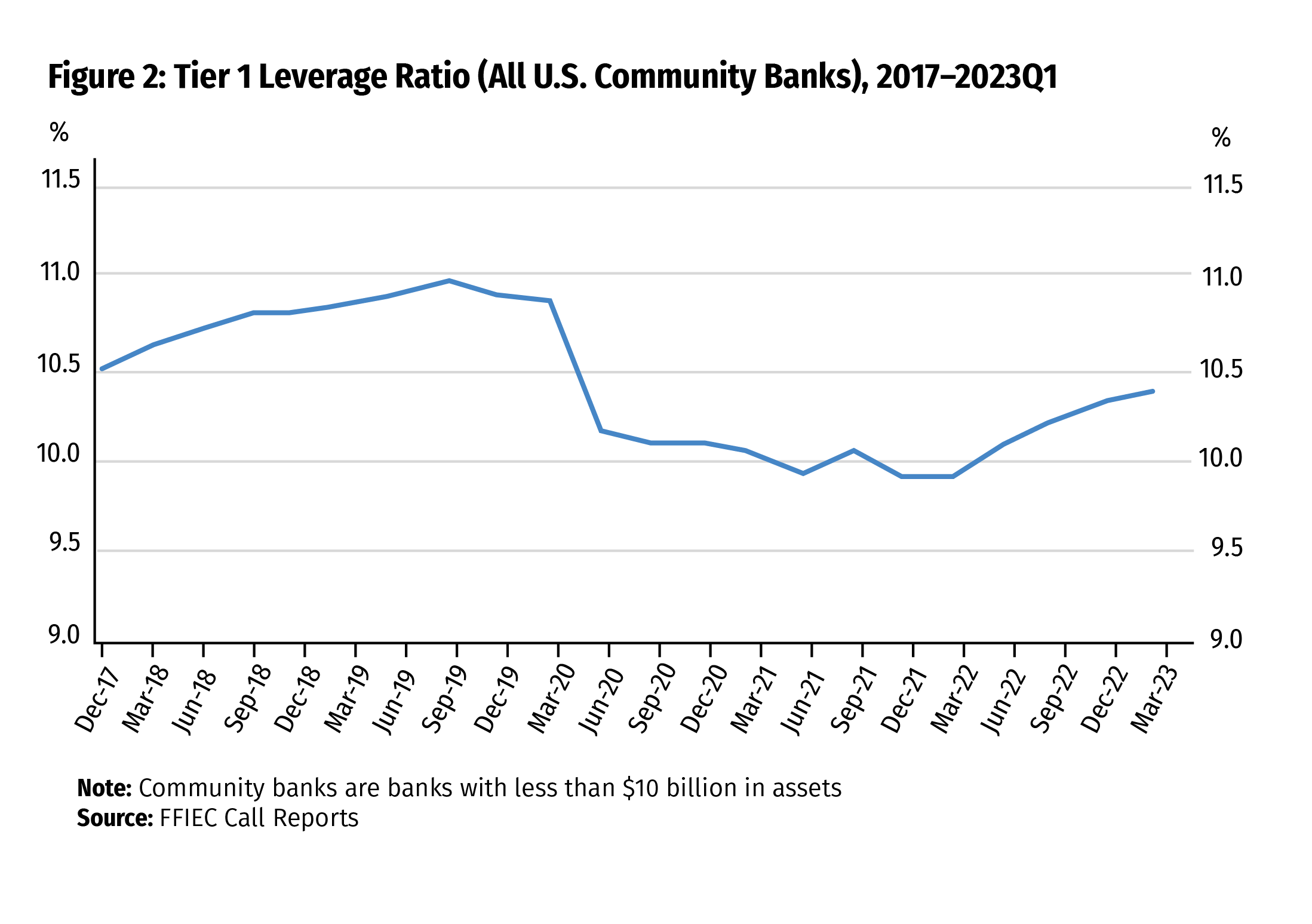

During the height of the COVID-19 pandemic, average capital levels at community banks declined, primarily because of substantial increases in total assets driven by an influx of deposits. Initially, the asset growth of community banks was primarily centered in cash and small business loans related to the Paycheck Protection Program (PPP). As PPP loans were forgiven and other loan demand remained depressed, many banks opted to place excess liquidity into longer-dated, higher-yielding securities to help bolster earnings. Later, in 2022, rapidly rising interest rates began to decrease the value of securities portfolios at the same time that loan demand picked up, resulting in much of the excess liquidity outside of bond portfolios being used to fund loan growth. While asset growth has moderated, community bank balance sheets remain larger than they were pre-pandemic.

As a result of these balance sheet changes, coupled with increased retained earnings and decreased dividend payments year over year during 2022,3 the average community bank tier 1 leverage ratio has improved since the height of the pandemic (see Figures 1 and 2).4

While earnings retention over a long period is a key element of long-term capital planning, the strategy of “going long” on securities during the pandemic resulted in significant unrealized losses to the balance sheets of many banks, as rapid interest rate increases negatively impacted securities valuations. Community banks have sought to address this issue in a variety of ways, including moving portions of the affected assets from available for sale to held to maturity.

These unrealized losses significantly impacted tangible capital. In cases of significant declines in value that lead to negative tangible common equity, banks are likely to face funding challenges, including restrictions on new borrowings and renewals of existing borrowings.5 In light of these potential funding challenges, the Federal Reserve implemented the Bank Term Funding Program6 in March 2023 to provide an optional liquidity buffer to banks.

Capital Planning Is Crucial in Any Economic Environment

In addition to external factors such as pandemic events and monetary policy shifts, internal factors shape the overall risk profiles of banks and capital planning activities. Some of these factors include high levels of asset growth; significant lending concentrations (particularly during times of stress to certain industries); and asset-quality challenges that could lead to elevated levels of adversely classified assets, past due loans, and losses. Ultimately, capital levels should be commensurate with risk and the tolerances established by the board of directors and implemented by bank management.

Risks to capital are exacerbated when external economic factors combine with risk layering at banks. For example, if a bank is experiencing tremendous growth because of an acquisition, is heavily concentrated in a particular lending segment, and has high levels of unrealized losses, risk management practices — including prudent capital planning — will be even more critical than if only one of these risks were present. The extent to which a bank’s assets are heavily risk weighted is another factor to consider when observing the risk layering of banks.

The concept of risk layering helps to illustrate the fact that there is not a one-size-fits-all approach to capital planning and, despite the existence of minimum regulatory capital levels and buffer requirements,7 there is no single capital level target that is appropriate for all institutions. An effective capital contingency plan appropriately captures the extent of a bank’s risk exposure and the depth of the risk mitigation strategies needed to support that risk.

Principles of Prudent Capital Planning

When accounting for possible risks to capital — whether environmentally based or because of a bank’s unique business model and established risk tolerance — it is paramount that bank management implements effective risk management processes surrounding capital contingency planning. In that vein, capital planning is a key tenet of the overall strategic planning processes of banks. As described in “Capital Planning: Not Just for Troubled Times,”8 one of the most important components of effective capital planning is a forward-looking approach. Given that the primary purpose of capital planning is to account for hypothetical scenarios that could cause loss to a bank, management and the board of directors are charged with anticipating a wide range of potential scenarios that could prompt the need for additional capital in a relatively short time frame.

A key first step to effective capital planning is defining and understanding the risk profile of an institution by conducting a risk assessment that analyzes the risks inherent in all of its financial components and operational aspects. Two key aspects of defining a bank’s risk profile include understanding its business model, including primary lending areas, and knowing who the bank’s customers are on both sides of the balance sheet. For example, deposit concentration risk is a key aspect of defining the overall risk profile of an institution. After the overall risk profile is established and understood, the board of directors can define a target capital level that is reasonable, attainable, meaningful, and appropriate with respect to the bank’s risk profile. With an appropriate target capital level (or levels) established, bank leadership is responsible for identifying triggers or alerts that, if breached, would prompt management to take specific actions to restore capital to target levels. Triggers are most meaningful when they are forward looking in nature and specific to aspects of the bank’s risk profile. For example, for banks concentrated in commercial real estate lending, a meaningful trigger for raising capital might be when the concentration level surpasses a specified threshold or when asset quality issues emerge in the form of significant adverse classifications or potential losses. Bank management is required to have proper management information systems in place to monitor triggers that could indicate a potential threat to a bank’s capital position, as well as to exercise the willingness to take action when it becomes necessary.9

The final piece of effective capital planning encompasses defining the capital risk mitigation strategies of banks — the action management takes, or the tools it leverages, to raise or preserve capital when it becomes necessary. To that end, it is important for capital planning to consider feasible actions or mechanisms for building capital, whether through bank holding company or shareholder support, the issuance of stock or suspension of dividends, debt issuances, or the improvement of capital ratios through shrinking assets or temporarily suspending asset growth. For any proposed action or mitigation strategy for increasing capital levels, bank management and the board of directors should clearly understand and outline: (1) the corresponding timeline for completing such events, (2) individuals’ responsibilities for enacting the plan, and (3) the potential negative impacts of these actions on other aspects of the bank. In all cases, bank management should analyze and understand how a shift in one area (or aspect) of the bank’s balance sheet could result in changes to other areas.

Conclusion

The benefit of hindsight illustrates the importance of capital planning to help banks withstand various challenges and economic conditions. Lessons throughout history have taught us that banks may not be able to raise capital when needed, depending on the circumstances and the market’s perceptions of a given institution. The unique risk profiles of banks and the impacts experienced from economic conditions at a given point in time have profound effects on capital levels. Regardless of whether the economic conditions at a specific point in time are challenging or favorable, every institution can benefit from understanding its risk profile and incorporating prudent capital planning into its overall risk management framework.

- 1 See Jennifer Burns, “Capital Planning: Not Just for Troubled Times,” Community Banking Connections, Third Quarter 2013, pp. 1, 8–11, available at www.cbcfrs.org/articles/2013/Q3/Capital-Planning-Not-Just-for-Troubled-Times.

- 2 See Alexander Shelton, “Helping to Ensure Capital Resiliency Through Effective Capital Planning,” Community Banking Connections, Fourth Issue 2020, pp. 7–8, 12, available at www.cbcfrs.org/Articles/2020/I4/helping-to-ensure-capital-resiliency-through-effective-capital-planning.

- 3 See Mary Bongers, “Fourth Quarter 2022 Banking Conditions,” Banking Conditions, Federal Reserve Bank of Kansas City, available at www.kansascityfed.org/banking/district-banking-conditions/fourth-quarter-2022-banking-conditions/.

- 4 See Chart S.1 in Sabrina Pellerin, “Bank Capital Analysis Semiannual Update,” Fourth Quarter 2021 and Fourth Quarter 2022, available at www.kansascityfed.org/Banking/documents/8816/Bank_Capital_Analysis_Report_-_4Q2021.pdf and www.kansascityfed.org/Banking/documents/9499/Bank-Capital-Analysis-Kansas-City-Fed-Q4-2022.pdf.

- 5 See “Rising Interest Rates Complicate Banks’ Investment Portfolios,” Resources for Eighth District Banks, Federal Reserve Bank of St. Louis, available at www.supervisionoutreach.org/posts/rising-interest-rates-complicate-banks-investment-portfolios.

- 6 See “Bank Term Funding Program,” Board of Governors of the Federal Reserve System, available at www.federalreserve.gov/financial-stability/bank-term-funding-program.htm.

- 7 See the Board of Governors of the Federal Reserve System’s Regulation Q in 12 C.F.R. Part 217.

- 8 The article is available at www. cbcfrs.org/articles/2013/Q3/Capital-Planning-Not-Just-for-Troubled-Times.

- 9 See the Board’s Regulation H at 12 C.F.R. Part 208, Appendix D–1.