Community Bank Liquidity: Balance Sheet Management Fundamentals

by Alex Lightfoot, Senior Risk Specialist, Supervision + Credit, Federal Reserve Bank of San Francisco and Anthony Gonitzke, Senior Examiner, Supervision + Credit, Federal Reserve Bank of San Francisco

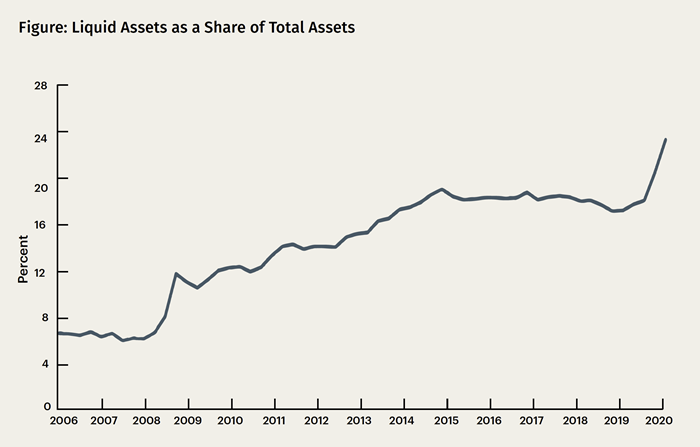

Banking organizations have been a source of strength, rather than strain, for the economy, entering the COVID-19 pandemic with substantial capital and liquidity and improved risk management and operational resiliency.1 During the initial stages of the pandemic, bank deposits grew at extraordinary rates through June 2020, as investors continued to favor safe assets and consumers increased savings (see the figure). Although this has helped to increase banks’ overall deposits and their overall level of liquid assets, the stability of this newfound funding remains uncertain.

For community banks, liquidity conditions remain favorable, with liquidity levels generally stable or increasing and with lower reliance on noncore funding. However, many community bank management teams have indicated they expect considerable runoff of deposits during the next several quarters. Further, community banks have indicated that they face a challenge in finding attractive investment opportunities for excess funds. Therefore, community banks are likely considering the investment of these funds and the liquidity risk of its asset management strategy. Longer-term assets, such as loans, may provide higher yields than interest-bearing bank balances or securities. However, given the unpredictability of these funds’ behavior, a community bank may also be considering a shorter-term strategy of investing in more liquid assets, such as readily marketable securities and interest-bearing bank balances.

Notes: Liquid assets are cash plus estimates of securities that qualify as high-quality liquid assets as defined by the liquidity coverage ratio requirement. Data include only firms that filed the FR Y-9C and exclude savings and loan holding companies.

Source: FR Y-9C. This chart appears as Figure 5 in the Federal Reserve’s Supervision and Regulation Report (November 2020), available at www.federalreserve.gov/publications/2020-november-supervision-and-regulation-report-banking-system-conditions.htm.

This conundrum is known commonly as the earnings–liquidity tradeoff, as there is generally an inverse relationship between the yield on an earning asset and its degree of liquidity risk. An overall lower level of liquid assets increases liquidity risk and reduces a bank’s ability to withstand liquidity stress events, both specific to the institution and in the wider market. Therefore, to manage liquidity risk appropriately, management teams should ensure that a sufficient cushion of liquid assets is maintained relative to the composition of funding and reasonably unanticipated funding needs. To aid a bank in navigating liquidity risk over the coming months, this article aims to illuminate the principles in sound funds management practices.

Liquidity Risk Management Guidance

The primary interagency guidance on liquidity risk management for community banks is Supervision and Regulation (SR) letter 10-6, “Interagency Policy Statement on Funding and Liquidity Risk Management.”2 The guidance articulates the process that depository institutions should consider in identifying, measuring, monitoring, and controlling their funding and liquidity risks. This article highlights a few aspects of the interagency guidance, namely liquid asset cushions, funding composition, and liquidity stress testing.

As a result of the COVID-19 pandemic, SR letter 20-15, “Interagency Examiner Guidance for Assessing Safety and Soundness Considering the Effect of the COVID-19 Pandemic on Institutions,”3 was developed to aid examiners in the review of supervised institutions, particularly community banks. This interagency guidance recognizes the uncertainty surrounding the effect of the pandemic on banks’ liquidity positions and directs examiners not to criticize a bank for the appropriate use of the Federal Reserve’s discount window or lending programs. Moreover, the letter states that a bank’s “prudent use of its liquidity buffer to support economic recovery” will not be criticized. The focus of the supervisory review of a bank’s liquidity risk will be on management's ability to adapt to the pandemic in its liquidity planning.

Cushion of Liquid Assets

A cushion of liquid assets is a key component in a bank’s overall liquidity position. The interagency supervisory guidance highlights that management should ensure that unencumbered, highly liquid assets are readily available. SR letter 10-6 states that “liquid assets are an important source of both primary and secondary funding at many institutions” and liquid assets allow banks to “effectively respond to potential liquidity stress.” The guidance makes clear the importance of having a cushion of liquid assets and that the appropriate level of liquid assets ultimately depends on a bank’s specific risk profile and activities.

Regulators have not been prescriptive in defining what constitutes a liquid asset or opined on the quality of the various types of liquid assets for community banks like they have done for the largest financial institutions.4 Community banks typically calculate a liquid asset ratio as the sum of the following Uniform Bank Performance Report (UBPR) categories divided by the bank’s total assets: interest-bearing bank balances, federal funds sold and repurchase agreements, unpledged securities, and trading assets. With no prescriptive calculation, institutions have the flexibility to monitor liquidity using a liquid asset ratio that reflects the nuances of their balance sheets and business models.

An institution’s management may choose a more granular definition of liquid assets and funding sources based on the behavior of the institution’s borrowers and depositors. For instance, management may subtract reserve requirements for balances held at a Federal Reserve Bank from interest-bearing bank balances or can exclude investment securities on an individual basis if management’s analysis identified them as not being readily marketable and liquid. A more granular calculation provides additional transparency into the bank’s true liquidity level. Lastly, it should be noted that cash and due from balances would generally not be included in the ratio calculation, as these funds are needed for ongoing daily bank operations. Because of this, Federal Reserve examiners would typically not consider these funds as a source of liquidity for funding purposes, unless management can provide a well-supported rationale for inclusion.

In addition to selecting a method to measure liquid assets, as outlined in SR 10-6, management should determine the appropriate level of liquid assets. Using the liquid asset ratio as defined above, state member banks (i.e., a state bank that is a member of the Federal Reserve System), on average, held 21.4 percent of liquid assets as of September 30, 2020.5

The appropriate level of liquidity for an institution depends on the institution’s risk profile. The composition and characteristics of funding sources and assets, as well as the level of off-balance sheet exposure are all important components. To the extent that a bank has considerably lower levels of liquid assets than its peers, it may be prudent to review historic and prospective funding needs to maintain sufficient levels of liquid assets to meet reasonably unexpected needs. Interagency guidance indicates that the level should be supported by the bank’s internal liquidity stress testing (more on that later).

Composition of Funding

Management’s understanding of its funding composition can aid funding stability and management of funding concentrations. In general, a community bank’s primary funding source is its deposits. Deposits are generally augmented by other types of funding, such as Federal Home Loan Bank borrowings and other types of borrowings, with the latter sources typically viewed as secondary sources of funding.

Management generally categorizes its funding sources as core or noncore funding, depending on their characteristics. A community bank’s core funding is generally composed of deposits that are sourced from the bank’s local market. These deposits are typically lower cost and relatively stable. While the Call Report instructions define the types of deposit accounts that are included in core deposits, some of the deposits within these categories may not be low cost or stable. From a liquidity risk management perspective, and to address the uniqueness of a bank’s deposit base, management may wish to identify other deposits to include as noncore deposits when assessing the stability of the bank’s deposit base and liquidity position.

Noncore funding is considered higher risk and is typically more volatile than core funding. Bank-specific or macroeconomic stress events can have a negative effect on noncore funding, which in turn can adversely affect the cost of these funds through higher interest rates, place restrictions on the maximum interest rates paid, increase collateral requirements, or lead to withdrawal or discontinuation of funds. Further, given that noncore funds are generally more volatile and costly, management should consider the level of reliance placed on these funds in the composition of its funding sources.

Management can consider conducting a deeper analysis into the behavior of its deposit base when determining whether a funding source is core or noncore. This analysis can help determine funding stability, or lack thereof, as some “core” sources might be volatile. Likewise, certain noncore funds may have more core-like attributes. If management believes that certain types of deposits do not fit within Call Report definitions for internal reporting purposes, management can attempt to identify and distinguish which deposits are truly core and noncore and provide well-documented support for these types of decisions. For example, a definitional core deposit could have a higher than usual cost or have underlying characteristics that place pressure on the stability of that deposit. As a result, a bank may consider these deposits as noncore. A bank should have appropriate support to explain the reason for changing the traditional characterization of these funds.

Given that the long-term stability of deposits acquired during the COVID-19 pandemic is unknown, liquidity risk management could be strengthened by identifying and closely monitoring the behavior of these newly acquired deposits separate from other deposits. Further, management is encouraged to use scrutiny before investing funds from deposit growth attributable to the pandemic, such as funds from Paycheck Protection Program (PPP) loans. Given the uncertain characteristics of these deposits, this scrutiny can include analysis on the tradeoff within investing in longer-term, less liquid assets, which could be more difficult to convert to cash, compared with more liquid assets.

Bank management can benefit from being aware of any funding concentrations that may exist and manage them appropriately. In general, examiners will assess funding concentrations against total assets as a method to determine the funding source of the bank’s assets. SR letter 10-6 provides several key elements for management to consider. In particular, “policies should clearly articulate a liquidity risk tolerance that is appropriate for the business strategy of the institution considering its complexity, business mix, liquidity risk profile, and its role in the financial system.” Moreover, a bank’s policies should include concentration definitions, risk limits approved by the bank’s board of directors, and definitions for measurement calculations.

SR letter 10-6 reminds bankers that risk management should focus on funding concentrations that address:

- “diversification of funding sources and types, such as large liability and borrowed funds dependency, secured versus unsecured funding sources, exposures to single providers of funds, exposures to funds providers by market segments, and different types of brokered deposits or wholesale funding”; and

- “term, repricing, and market characteristics of funding sources with consideration given to the nature of the assets” being funded. “This may include diversification targets for short-, medium-, and long-term funding; instrument type and securitization vehicles; and guidance on concentrations for currencies and geographical markets.”

Taking a step further, management can avoid noncore-funding concentrations by developing an aggregate noncore funding limit. As recognized in the Federal Reserve’s Commercial Bank Examination Manual, small community banks, especially those in rural or highly competitive areas, may face a challenge in avoiding a funding concentration.6 However, a bank’s board of directors and senior management need to establish limits and develop appropriate management information system reporting to manage its funding concentrations. This is even more important as community banks continue to face competition for deposits from large banks, online banks, financial technology firms, and nonbanks, as well as outflows from rural areas to urban cities.

Liquidity Stress Testing

Interagency supervisory guidance indicates that it is prudent for banks to “conduct stress tests regularly for a variety of institution-specific and marketwide events across multiple time horizons” taking into account their own “complexity, risk profile, and scope of operations.”7 These tests help banks effectively manage liquidity risk by identifying and quantifying potential liquidity strains. The results of testing can aid a bank in evaluating the appropriateness of its asset liquidity levels. The extent and complexity of a community bank’s internal analysis of liquidity needs under stressed conditions depend on the bank’s asset size and complexity, commensurate with the bank’s risk profile and business model. This analysis is expected to capture the bank’s entire balance sheet, including off-balance sheet exposures, and incorporate a range of reasonably unanticipated situations that could subject the institution to liquidity stress.

Reasonably unanticipated liquidity scenarios should include appropriate assumptions that are supported and reflect idiosyncratic and systemic risks. The results of this scenario analysis inform a bank’s board of directors and management about the bank’s preparedness to meet reasonably unexpected liquidity needs. In addition, this analysis can inform management in determining the appropriate levels of asset liquidity to hold or justify internal targets or limits.

Finally, most liquidity events are abrupt and result in immediate and significant outflows, illustrating the importance of having a cushion of liquid assets available during stress events. The timing and availability of contingency funding sources should be considered to determine whether sufficient funding will be available if the bank needs it. Further, the results of this analysis should help inform management on the appropriate level of liquid assets that provides an effective cushion against stress events.

Key Takeaways

Liquidity can be broken down into two main components: (1) liquid assets, which provide a cushion to meet unexpected cash outflows, and (2) a measure of stressed outflows, determined primarily by the composition of funding. Although there is no required minimum level of liquid assets, the level maintained by a community bank should be informed and supported by management’s liquidity analysis. One approach management can consider is comparing the bank’s UBPR liquidity metrics to those of other state member banks or peer averages to better understand their liquidity risk profile relative to the broader population. On the liability side, management should focus on obtaining a stable deposit base and, if possible, avoid funding concentrations and significant use of nonstable funding sources. The avoidance of concentrations in noncore funding sources can be achieved with prudent concentration limits by noncore funding type, as well as an aggregate funding concentration limit. Additionally, close monitoring of recent increases in deposits arising from the pandemic is encouraged, given the unknown long-term behavior of these deposits. If both sides of the balance sheet exhibit sound liquidity metrics, the institution can more easily manage its liquidity risk under stressful conditions. With an appropriate level of liquid assets and a well-diversified funding base, institutions will have the ability to remain resilient during periods of liquidity stress.

- 1 See the Federal Reserve’s Supervision and Regulation Report (November 2020), available at www.federalreserve.gov/publications/2020-november-supervision-and-regulation-report.htm.

- 2 SR letter 10-6 is available at www.federalreserve.gov/boarddocs/srletters/2010/sr1006.htm.

- 3 SR letter 20-15 is available at www.federalreserve.gov/supervisionreg/srletters/sr2015.htm.

- 4 The largest institutions are subject to the liquidity coverage ratio rule (LCR), which is a standardized liquidity metric that compares a bank’s liquid assets to stressed outflows over a 30-day time horizon; however, the LCR rule does not apply to community banks.

- 5 This percentage is based on aggregate Call Report data.

- 6 See the Commercial Bank Examination Manual, available at www.federalreserve.gov/publications/supervision_cbem.htm.

- 7 See SR letter 10-6.