Navigating the Great Deposit Migration Through Interest Rate Risk Modeling

by Ryan Bolig, Senior Analyst, Federal Reserve Bank of Philadelphia; Susan Maxey, Surveillance Manager, Federal Reserve Bank of Richmond; and Donna Thompson, Capital Markets Specialist, Federal Reserve Bank of Richmond

Through the wake of the financial crisis and ensuing postrecession period, deposits at community banks grew significantly, strongly weighted in nonmaturity deposits (NMDs). While increased volumes of NMDs offer low funding costs and additional liquidity, new challenges loom as interest rates begin to inch upward from historical lows.

How will rising interest rates affect funding profiles? Will changing deposit compositions adversely affect profitability? What impact will increasing rates have on interest rate risk (IRR)?

Banks commonly use IRR modeling to help answer these questions. Model results help inform management's tough decisions; however, as mentioned in a previous Community Banking Connections article on IRR measurement, inaccurate data inputs or model assumptions, especially those surrounding deposits, can produce unreliable model output that may result in poor decision-making.1 This article expands on a series of IRR articles in previous issues of Community Banking Connections2 to shed light on some common characteristics of current deposit bases that can affect the reliability of IRR modeling results and, subsequently, management's risk mitigation strategies.

The Importance of Understanding a Deposit Base

Understanding the characteristics of a bank's deposit base is crucial to determining how rate changes may affect the bank's profitability, liquidity, and exposure to interest rate changes. Consider the current postcrisis environment, which is characterized by low interest rates, limited alternative investment opportunities, and general risk aversion. This atmosphere has led many consumers and businesses to hold excess cash in the form of bank deposits. In fact, between 2006 and 2013, community bank3 deposits grew by $159 billion, or 9 percent. Concurrently, banks also witnessed a noticeable shift in deposit composition, from time deposits into nonmaturity products such as money market and savings accounts. Such rapid growth and changing compositions have led examiners to ask:

- How were these new deposits obtained? Are these new customer accounts or increased balances of established account holders? Did external factors (such as the economic environment) contribute to the deposit growth, or did internal factors (such as banks' deposit pricing being above market) bring about the change?

- Are these new deposits stable or temporary? Will they leave when higher-yielding investment opportunities arise?

- Are these new deposits more price-sensitive? Will they convert to higher-yielding accounts (such as time deposits) or leave the banking system when rates increase?

IRR models rely on assumptions based on deposit characteristics. By researching these characteristics in the context of banks' unique deposit bases and applying the knowledge gained directly to modeling inputs, banks can enhance the reliability of model outcomes. Otherwise, poorly designed models have the potential to produce misleading output and less-than-optimal decisions, perhaps impeding bank management from correctly mitigating risks.

Tips to Better Understand the Deposit Base

IRR modeling output relies heavily on two deposit assumptions:

- Effective duration (or average life)

- Price sensitivity (i.e., beta4)

Traditionally, NMDs are assumed to be less volatile than other funding sources. As such, many IRR models assume that NMDs exhibit longer durations or average lives and lower price sensitivities (betas) to rate changes than other funding sources. However, given that the low rate environment of the past few years has been accompanied by deposit growth and shifts in deposit mix, banks should revisit these assumptions to see if they still hold true today for their deposit bases. Management may need to alter these assumptions because recent deposit inflows may not exhibit the same stable characteristics as traditionally assumed.

Two strategies to assist bankers in better understanding their institutions' deposit bases include:

- Historical trend analysis

- Communication with large depositors

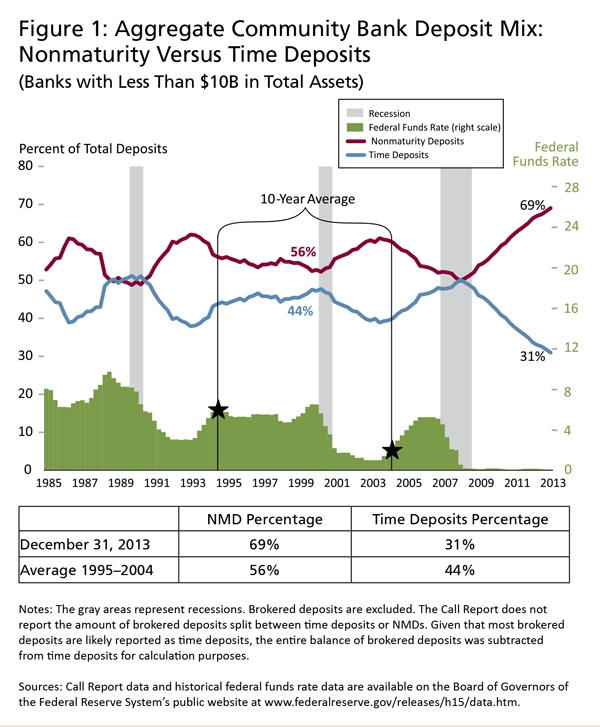

Historical trend analysis of deposit growth rates and deposit mix changes is a good place to begin when evaluating exposure to rising rates. This involves, at a minimum, assessing the current composition of deposits (NMD versus time) compared with a historical composition in order to identify the magnitude of deposit mix shift within the institution. Figure 1 demonstrates this analysis performed on the entire community bank population. Year-end 2013 data show that NMDs represented 69 percent of total deposits compared with a historical average of 56 percent before the recession. This shift may have resulted from consumers reacting to the prolonged low rate environment, risk aversion, or limited alternative investment opportunities. Regardless of the drivers of the deposit shift, when interest rates rise, bank management should consider the extent to which deposit levels and composition may revert closer to historical norms.

The figure uses a 10-year prerecession average as the basis for historical comparison. This time frame is chosen to represent a full rate cycle — identified in the figure by the starred rate peak and trough in 1995 and 2004, respectively. Using the appropriate historical comparison time period is crucial to extracting reasonable results. Historical analysis may be misleading if data represent only a short or static time horizon. This is especially true in cases such as the current prolonged rate environment in which data from the most recent few years may produce unreasonable results.

In addition to reviewing historical trend analysis, discussions with large deposit-holding customers can provide invaluable insights into deposit stability and price sensitivity. To supplement rate cycle data (or when rate cycle data are unavailable), management may find it beneficial to make inquiries as to depositors' intentions.

Incorporating the Unique Characteristics of a Bank's Deposit Base to Ensure Reliable Model Results

If history is any indication of future depositor behavior, as interest rates rise banks may need to manage the impact to funding costs, liquidity, and IRR. As evidenced in Figure 1, depositors have historically preferred to lock in higher yields through instruments with stated maturities, such as time deposits, during higher-rate environments. As rates rise and time deposits regain attractiveness relative to NMDs, banks may need to decide whether to:

- compete for NMDs through competition-driven rate increases;

- face potential composition shifts back into time deposits with higher interest costs;

- replace currently inexpensive NMD funding with wholesale money; or

- use a combination of these three options.

Models designed to measure economic value of equity (EVE), earnings at risk (EAR), and liquidity through various rate scenarios can provide valuable forward-looking predictions to inform this type of decision-making. As previously stated, however, model results are only as useful as the embedded assumptions. Because deposits are a key source of funding for most community banks, assumptions related to how deposits respond to changes in interest rates are important drivers of model results. As such, ensuring that these assumptions are reasonable is essential to obtaining reliable output. Absent rational deposit assumptions, model results may lead management to decisions that could inadvertently worsen the bank's exposure to interest rate changes, thus affecting future profitability and liquidity positions.

Projecting EVE and EAR

Given the heightened level of NMDs in community banks today, it is important that banks apply appropriate effective durations (or average lives) and price sensitivity assumptions (i.e., betas) in IRR modeling. Because newer segments of NMDs acquired during the financial crisis may not behave like typical core deposits, banks should exercise caution when applying behavioral modeling assumptions to this group of deposits. Traditional assumptions associated with NMDs (long average lives and lower price sensitivities) may understate the volatility of some of these newer segments of NMDs, which, in turn, may produce model results that understate the potentially negative impact rising rates could have on earnings and capital. Institutions should update their model assumptions to capture changes in funding mix to ensure any adverse impact is appropriately considered and planned for so that management can make well-informed decisions.

Projecting Liquidity Risk

Although NMDs are classified as core deposits5 for regulatory reporting purposes, the influx over the past few years may or may not exhibit the same stable characteristics that traditional core deposits have historically demonstrated. As such, banks should understand and use the factors driving deposit mix changes to estimate potential deposit outflows as well as the increased expense that could occur in upward rate environments. This is particularly important for contingency funding plans, where inaccurate assumptions could overstate the stability of core funding. Such overstatements can lead to unreliable cash flow models and misleading contingency funding scenarios. To mitigate this issue, bank management should reexamine deposit assumptions periodically and exercise caution when relying solely on historical information, as conditions and resulting depositor behavior may change.

Understanding and Reporting Modeling Results

As discussed previously, interest rate and liquidity risk models rely heavily on assumptions, so it is important for management to understand the impact these assumptions can have on model results. Employing two additional strategies can help add clarity to model outcomes:

- Simulating multiple scenarios

- Conducting sensitivity testing

Banks are encouraged to simulate multiple IRR scenarios to better understand how model outcomes differ under various deposit assumptions. This is particularly important in today's environment given the uncertainty surrounding depositor behavior. Scenario analysis surrounding deposit mix projections is particularly important for banks that have experienced significant deposit growth or changes in their deposit composition.

Sensitivity testing can also aid in directors' and senior management's understanding of model results. Sensitivity testing quantifies the impact that key assumptions have on projected levels of earnings and capital in changing rate scenarios. This is an important risk management and measurement tool, as the results of this testing inform management about the potential exposure if actual key indicators were to differ from model assumptions.

Finally, comprehensive communication is critical to the board's and senior management's interpretation of model results. Board and senior management reporting should capture model results related to interest rates, earnings, liquidity, and capital. When appropriate, management may need to make qualitative adjustments to ensure the reasonableness of results. If this is the case, banks should ensure that the rationale for qualitative adjustments is discussed at appropriate committee meetings and is adequately documented. Key model assumptions should be periodically reviewed and discussed, approved, supported, and documented.

Conclusion

A potential change in the interest rate environment introduces challenges for community bank management, and changes to funding compositions and deposit growth over the past few years add to the complexity of these challenges. IRR modeling can provide valuable predictions to inform these decisions, but appropriate assumptions are crucial to delivering reliable model results. As management steers institutions forward, it will be important to consider the unique characteristics of each bank's deposit base in order to derive reliable model results that foster sound decision-making.

Back to top

- 1 See Emily Greenwald and Doug Gray, “Essentials of Interest Rate Risk Measurement,” Community Banking Connections, Third Quarter 2013, available at www.cbcfrs.org/articles/2013/Q3/Essentials-of-Effective-Interest-Rate-Risk-Measurement.

- 2 Three previous issues of Community Banking Connections included articles on IRR. The first article, “Interest Rate Risk Management at Community Banks,” provided an overview of key elements of an IRR management program; the second, “Effective Asset/Liability Management: A View from the Top,” focused specifically on directors’ and senior managers’ responsibilities, such as implementing sound policies and IRR exposure limits; and the third, “Essentials of Effective Interest Rate Risk Measurement,” emphasized risk measurement issues. These articles are available at www.cbcfrs.org/articles/2012/Q3/interest-rate-risk-management, www.cbcfrs.org/articles/2013/Q1/Effective-Asset-Liability-Management, and www.cbcfrs.org/articles/2013/Q3/Essentials-of-Effective-Interest-Rate-Risk-Measurement, respectively.

- 3 For the purpose of this article, community banks are defined as those with total assets of $10 billion or less.

- 4 Beta refers to the price sensitivity of deposit accounts for a given change in interest rates. For example, if rates increase by 100 basis points, a beta of 25 percent means deposit rates will increase 25 basis points.

- 5 Core deposits are the sum of demand deposits, negotiable order of withdrawal, and automatic transfer service accounts; money market deposit and other savings accounts; and time deposits less than $250,000. Core deposits are generally thought to be more stable sources of funding and less sensitive to interest rate changes.