Reversing the Trend: An Examiner's Thoughts About Negative Provisions and the ALLL

by Stephen Wheatley, Portfolio Manager, Federal Reserve Bank of Chicago

As the industry emerges from the financial crisis and estimates of the allowance for loan and lease losses (ALLL) have declined, some banks have begun reporting "negative provisions." This article discusses accounting for negative provisions and how Federal Reserve examiners evaluate the appropriateness of negative provisions.

What Is a Negative Provision?

In its basic form, a negative provision occurs when the allowance estimate at quarter-end is lower than the allowance per the general ledger. For example, assume that a bank has an ALLL balance of $150,000 at the end of November. In December, the ALLL methodology indicates that a lower balance of $125,000 is appropriate because of an improved economic environment, improved asset quality, and lower historical loss rates. In this case, the bad debts expense or provision would be ($25,000).

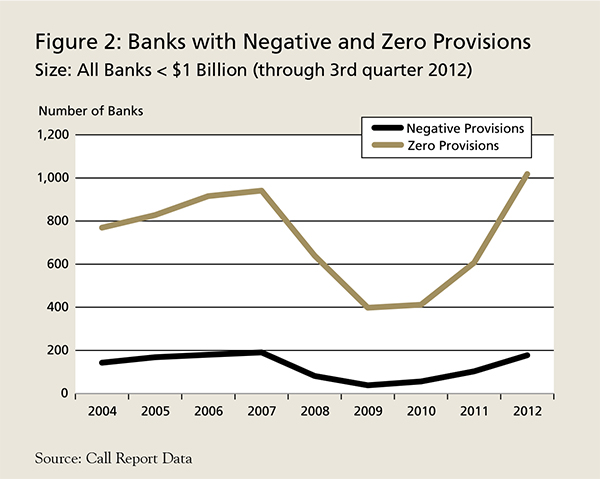

Negative provisions are not new. During the economic expansion from 2004 to 2007, many institutions recorded negative provisions. More recently, some community banks have also begun recording negative provisions.

Why Are Banks Reporting Negative Provisions?

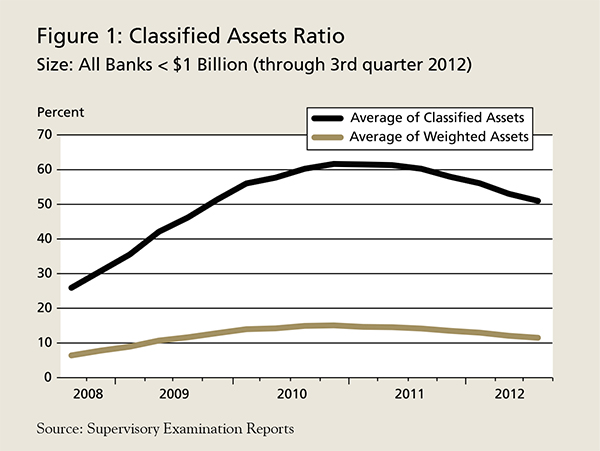

Banks are reporting negative provisions because estimates of the allowance are declining. The decline in credit risk – as evidenced by declining charge-offs, declining delinquency rates, and declining adversely classified assets – coupled with improving economic indicators may have resulted in lower ALLL estimates. As shown in Figure 1, classified asset ratios at banks with total assets of less than $1 billion began to stabilize and decline beginning in mid-year 2011 (black line).1 And as the volume of assets with the more severe classification ratings of "doubtful" and "loss" has declined, the weighted classifications ratio (gold line) has also improved.2

How Many Institutions Have Reported Negative Provisions?

As shown in Figure 2, the number of banks under $1 billion in total assets recording negative provisions began to increase in 2010, with the trend continuing through the third quarter of 2012. At the end of 2010, only 56 banks, or 0.91 percent of banks, recorded a negative provision, but the proportion quickly increased to 178 banks, or 2.89 percent, as of the third quarter of 2012. At the same time, the number of banks incurring zero provisions increased dramatically beginning in late 2010 and into 2012. During 2010, 412 banks, or 6.68 percent of the banks sampled, reported zero provisions (as illustrated in Figure 2), which almost tripled to 1,018 banks, or 16.51 percent of banks, as of the third quarter of 2012.

Is It Acceptable to Record a Negative Provision?

Lowering the ALLL through a negative provision is permitted under generally accepted accounting principles (GAAP). Accounting standards for loan losses allow banks to reduce reserves through negative provisions, and regulators are not opposed to the practice provided that the decision is well supported. When reviewing negative provisions, examiners focus on the appropriateness of the decision in light of the many factors that should be considered in estimating the allowance.

Under GAAP, changes in estimates are not considered errors. Rather, changes in estimates are accounted for in the period in which the estimate changes. Adjustments to the ALLL simply reflect changes in estimates, which in certain situations may need to be accomplished by booking a negative provision.

During each examination or as part of ongoing monitoring, examiners will evaluate whether a bank’s ALLL methodology and the supporting loan review systems and other controls are effective in determining and maintaining an appropriate ALLL. Examiners will evaluate whether the bank has: a) reliable loan review systems and other controls providing effective identification of credit risk, b) an acceptable methodology and process that meet GAAP and interagency supervisory guidance, and c) documentation that demonstrates reasonable and properly supported assumptions, including analysis of significant environmental factors.

In the event a bank reports lower allowances through negative provisioning, examiners will review documentation justifying the bank’s decision, including peer analysis conducted by the bank and board minutes. Documentation should describe changes to loan ratings, impairment measurements, loss rates, and environmental factors that have led to reductions in the allowance. Examiners will ensure that management’s assumptions surrounding the environmental factors and asset quality (such as lower charge-offs and nonperforming loans) are reasonable and supportable and that the decision to take a negative provision was not made to provide an artificial boost to earnings. Examiners may also hold discussions with the bank’s external auditors.

Expectations for improving credit quality should be based on sustained trends, and changes to the ALLL should be consistent with trends in credit risk (such as the level of nonperforming loans, loan grading migration, and new additions to the watch list). Examiners would have concerns if allowance levels are declining while the level of credit risk is still elevated and a large pipeline of watch list credits is still evident.

Other red flags that may concern examiners include:

- Abrupt and significant changes in environmental factors that are not directionally consistent with observable data or adjustments to impairments that are not based on current collateral valuations or otherwise supportable;

- Upgrades in loan ratings where the borrower’s financial circumstances have not changed or the terms of the loan are not materially altered to improve collectability;

- Inappropriate removal of large losses from the bank’s loss history when calculating historical loss rates on groups of loans;

- Overly optimistic assumptions when estimating expected future cash flow assumptions for the present value of cash flow calculation (for example, not incorporating probability of default or prepayment assumptions);

- Widespread use of stale appraisals when measuring impairment on collateral-dependent loans;

- Modifications offered by the bank lack prudent repay- ment terms in order to keep loans current (for example, long amortization periods, interest-only periods, or single pay notes when those features are not standard for the loan type);

- Nonrecognition of loan impairment or troubled debt restructurings; and

- A change in the historical look-back period or a reseg- mentation of the portfolio in order to arrive at a lower ALLL.

Factors that might support recording a lower ALLL through a negative provision include:

- A sustained reduction in watch list and classified loans;

- A sustained decline in delinquency and charge-off rates;

- Steadily improving economic conditions supported by credible sources;

- Reduction in high-risk segments from the loan portfolio (e.g., construction and land development); and

- An allowance estimate above the upper range of the allowance calculation when the estimate is based on a sound methodology.

Concluding thoughts

It is a good practice for a bank to notify its primary supervisor to discuss the bank’s particular situation before recording a negative provision. Examiners recognize that the allowance estimate requires a high degree of managerial judgment. Nonetheless, examiners also view the ALLL as one of the most significant estimates in a bank’s financial statement. As such, provisioning practices remain central to examiners’ overall assessment of banks. Management of a bank that is appropriately recognizing problems and managing credit risk should not feel reluctant to discuss a decision to reduce the bank’s ALLL with its primary regulator when a well- documented, sound methodology, including appropriate sup- port for any significant changes in loan ratings, impairment measurements, loss rates, and environmental factors, suggests that such a reduction is appropriate.

Back to top

- 1 Classified assets are the sum of watch list loans or investments graded "substandard," "doubtful," and "loss" divided by the sum of the bank’s tier 1 capital and ALLL. Bank examination data are based on the "as-of" date.

2 Problem loans are weighted according to their severity. The weighted sum is divided by the sum of the bank’s tier 1 capital and ALLL. - The author would like to thank Paul Jordan and John Mansfield of the Federal Reserve Bank of Chicago for their contributions to this article.