The Regulatory Capital Proposals: Frequently Asked Questions

On June 7, 2012, the Federal Reserve Board invited comment on three proposed rules revising the regulatory capital rules for state member banks, bank holding companies, and savings and loan holding companies. Shortly thereafter, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation also published the proposals for comment. The agencies’ proposals can be found at:

http://www.federalreserve.gov/newsevents/press/bcreg/20120607a.htm.

This article highlights frequently asked questions from community bankers that Board staff received at "Ask the Fed" and other outreach events.

- To which institutions do the proposals apply?

The two proposals relevant to community banking organizations would apply to all banks, savings associations, and savings and loan holding companies, as well as bank holding companies that are currently subject to minimum capital requirements. Like the current regulatory capital rules, the proposals would not apply to bank holding companies that are subject to the Board’s Small Bank Holding Company Policy Statement, which generally applies to bank holding companies with under $500 million in total assets.

Under section 171 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act, or the act), the Board is required to establish consolidated capital requirements for all savings and loan holding companies. The act does not include a provision similar to that provided for small bank holding companies that would exempt small savings and loan holding companies from such requirements.

- Why are the banking agencies proposing revising the capital rules for all banking organizations when the Basel Accord applies only to internationally active banks?

These revisions are designed to increase the resiliency of the U.S. banking system and help all banking organizations maintain strong capital positions, which will enable them to continue lending to creditworthy households and businesses in their communities even after unforeseen losses and during severe economic downturns. Specifically, the revisions would improve the quality and quantity of banking organizations’ capital, enhance the risk sensitivity of the current rules, and address weaknesses identified over the past several years.

The recent financial crisis demonstrated that the level and quality of a banking organization’s capital was a primary factor in its ability to withstand adverse conditions and continue lending to households and businesses. This is just as true for small institutions as it is for large ones. Not only will stronger capital add resilience to individual institutions, but all banking organizations, including community banking organizations, also benefit from the strengthening of the entire financial system. Aggregate additional capital held by all institutions should reduce volatility in financial markets and collateral valuations.

The proposals also address certain requirements of the Dodd-Frank Act and eliminate inconsistencies across the agencies’ current capital standards. The revisions are designed to address the activities and risks most relevant for specific banking organizations, and while the proposed definition of capital would be largely consistent across banking organizations, certain prudential measures such as the supplementary leverage ratio, countercyclical capital buffer, and enhanced measures of counterparty credit risk apply only to large, complex banking organizations currently subject to the advanced approaches (Basel II) risk-based capital rule.

- Is there a summary of the requirements relevant to community banks? If so, where is it located?

Because of the complexity of the proposals, not all of which necessarily apply to community banking organizations, the agencies developed two summaries to help direct smaller institutions to those sections of the proposals that are most likely to affect them. The summaries can be found in:

Addendum 1 in the notice of proposed rulemaking (NPR) titled Regulatory Capital Rules: Regulatory Capital, Implementation of Basel III, Minimum Regulatory Capital Ratios, Capital Adequacy, and Transition Provisions, which contains a summary that discusses the proposed revisions to the definition of capital, the new minimum capital ratios, the capital conservation buffer, and the eligibility criteria for regulatory capital components. http://www.federalreserve.gov/newsevents/press/bcreg/20120607a.htm

Addendum 1 in the NPR titled Regulatory Capital Rules: Standardized Approach for Risk-Weighted Assets; Market Discipline and Disclosure Requirements, which contains a summary of the proposed revisions to the calculation of risk-weighted assets relevant for community banks. http://www.federalreserve.gov/newsevents/press/bcreg/20120607b.htm

Additional information can be found in the "Ask the Fed" presentations, titled Recent Proposals to Enhance Regulatory Capital Requirements: What You Need to Know, which were presented on July 16, 2012, at the Federal Reserve Bank of Chicago and on July 18, 2012, at the Federal Reserve Bank of Kansas City.

- Why were the capital proposals issued in three separate notices of proposed rulemaking (NPRs)?

The rulemaking was divided into three separate NPRs to reflect the distinct objectives of each proposal, to allow interested parties to better understand the various aspects of the overall capital framework, including which aspects of the rules would apply to which banking organizations, and to help interested parties better focus their comments on areas of particular interest. Together, the proposals would establish an integrated regulatory capital framework and address inconsistencies across the agencies’ current capital standards.

- How will community banks be affected by these proposals?

Based on our analysis, the Board expects that more than 90 percent of community bank holding companies that currently meet the existing regulatory capital minimums would also meet the fully phased-in minimum requirements. More than 80 percent would meet the fully phased-in requirements plus the capital conservation buffer. For those organizations that do not yet meet the minimums and buffer, the proposals include a lengthy transition period to allow them time to come into compliance largely through retention of earnings.

- What are the new risk-based capital minimums?

The proposals would change both the definition of capital and the minimum risk-based capital ratios in order to ensure strong levels of high-quality capital across all subject institutions and to help them withstand periods of significant stress. The proposed rule defines regulatory capital components as common equity tier 1 capital, additional tier 1 capital, and tier 2 capital.

With respect to the risk-based capital ratios, the proposal would introduce a new minimum common equity tier 1 capital ratio of 4.5 percent and would increase the current minimum tier 1 capital ratio from 4 to 6 percent. The minimum total capital ratio would remain at 8 percent. In addition, the proposal sets forth stricter eligibility criteria for regulatory capital instruments that focus on improving their loss absorbency. The proposed minimums would be fully phased in by January 1, 2015.

- How would the leverage ratio be affected by the proposals?

The proposals would maintain the current 4 percent minimum ratio of tier 1 capital to total average assets, using the revised definition of tier 1 capital as the numerator. The proposal would discontinue the 3 percent minimum ratio currently permitted for banking organizations with a CAMELS rating of "1" or bank holding companies with an RFI rating of "1" or that are subject to market risk capital requirements.

- How would the proposals revise the prompt corrective action framework?

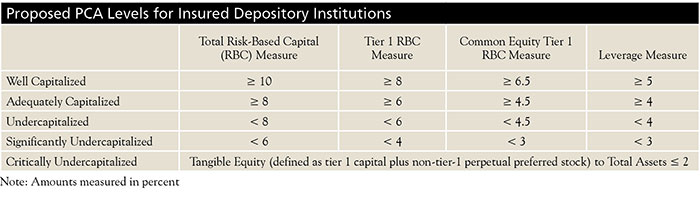

The proposals would revise the prompt corrective action (PCA) framework for insured depository institutions by incorporating the new minimum regulatory capital ratios; modifying the definitions of tier 1 capital and total capital, as well as the calculation of risk-weighted assets, consistent with other parts of the proposal; and updating the definition of tangible common equity with respect to the critically undercapitalized PCA category. The proposals would not change existing requirements and limitations on banking organizations’ activities within the PCA categories, but it would change the minimum thresholds within each of those categories. Specifically, with regard to the thresholds and as summarized in the table below:- The tier 1 column would be revised to reflect the increased minimum tier 1 ratio of 6 percent;

- The common equity tier 1 column would be added to reflect the new common equity tier 1 ratio; and

- For leverage, the current exception that permits the lower 3 percent threshold if certain criteria were met would be removed.

The proposed changes to the current minimum PCA thresholds and the introduction of a new common equity tier 1 capital measure would take effect January 1, 2015.

- How would the proposed capital conservation buffer interact with the proposed revisions to the PCA framework?

The proposed capital conservation buffer would function as a separate regime from the PCA framework and is designed to give banking organizations incentives to retain rather than distribute capital as their risk-based capital ratios approach the minimum required ratios. Specifically, a banking organization would need to hold a buffer of 2.5 percent of risk-weighted assets in common equity tier 1 capital in addition to its minimum risk-based capital requirements in order to avoid restrictions on capital distributions and discretionary bonus payments to executive officers.

As the buffer shrinks, the banking organization would be subject to increasingly stringent restrictions on capital distributions and discretionary bonus payments to executive officers. The buffer is designed to act as a shock absorber and help banking organizations survive stressful periods. Therefore, under the proposal, a bank would be allowed to use up to 50 basis points of its capital conservation buffer and still be considered well capitalized. While subject to restrictions on capital distributions and discretionary bonus payments, a bank with a capital conservation buffer between 0 and 2 percent of risk-weighted assets would be adequately capitalized for PCA purposes provided that it meets the minimum regulatory capital ratios.

The capital conservation buffer would be phased in between 2016 and 2018.

- Will trust preferred securities continue to be included in tier 1 capital under the proposals?

Under the proposals, trust preferred securities would not qualify for inclusion in tier 1 capital because such securities would not comply with the eligibility criteria for additional tier 1 capital instruments. The agencies believe that trust preferred securities, which are not perpetual and allow for the accumulation of interest payable, are not sufficiently loss-absorbent on a going concern basis to be included in tier 1 capital. However, trust preferred securities could qualify for inclusion in tier 2 capital if they meet the proposed eligibility criteria for tier 2 capital instruments.

The exclusion of trust preferred securities from the tier 1 capital of bank holding companies and savings and loan holding companies is consistent with section 171 of the Dodd-Frank Act, which requires that such instruments issued by these organizations with $15 billion or more in total consolidated assets be phased out over a period of three years beginning in 2013. In addition, the agencies proposed that trust preferred securities issued by bank holding companies and savings and loan holding companies under $15 billion in total consolidated assets be phased out over a 10-year period beginning in 2013.

- Under the proposals, how will gains and losses on available-for-sale debt securities be treated?

Unlike under the current rule, under the proposals, unrealized gains and losses from available-for-sale debt securities would flow through to common equity tier 1 capital. This effect is phased in over five years.

- Why is the treatment of gains and losses on available-for-sale debt securities being revised?

The agencies believe that this treatment better reflects an organization’s ability to absorb losses and remain a going concern at a particular point in time. If unrealized losses were neutralized and permitted to flow through to common equity tier 1, then an institution’s loss absorption capacity would be overstated. Such an approach is also consistent with the increased focus by both supervisors and market participants on an institution’s tangible common equity as a better gauge of its financial strength.

The agencies recognize that including unrealized gains and losses related to certain debt securities whose valuations primarily change as a result of fluctuations in a benchmark interest rate could introduce substantial volatility in a banking organization’s regulatory capital ratios. Likewise, the agencies recognize that such potential volatility could influence banking organizations’ investment decisions.

As a result, the agencies are seeking specific feedback from commenters on this proposed treatment, particularly the extent to which it could lead to excessive volatility in regulatory capital, as well as alternatives the agencies should consider.

- How are interest-only residential mortgages treated under the proposals

Under the proposal, residential mortgages would be divided into two categories (category 1 or category 2) based on whether they meet certain prudential underwriting criteria and product characteristics. An interest-only residential mortgage would be considered a category 2 mortgage because it does not require regular periodic payments that do not:

(i) result in an increase of the principal balance; (ii) allow the borrower to defer repayment of the principal of the residential mortgage exposure; or (iii) result in a balloon payment.

During the recent market turmoil, the U.S. housing market experienced significant deterioration and unprecedented levels of mortgage loan defaults and home foreclosures. The causes for the significant increase in loan defaults and home foreclosures included inadequate underwriting standards; the proliferation of high-risk mortgage products, such as so-called pay option adjustable rate mortgages, which provide for negative amortization and significant payment shock to the borrower; the practice of issuing mortgage loans to borrowers with unverified or undocumented income; and a precipitous decline in housing prices, coupled with a rise in unemployment.

As a result, the agencies proposed a risk-weight framework that would assess risk-based capital based on the risk inherent in a residential mortgage. Specifically, residential mortgages in both categories would be assigned a risk weight based on their loan-to-value (LTV) ratio, determined at the time of origination.

Category 1 mortgages would be first-lien amortizing mortgages that have been prudently underwritten and have more conservative product features. Such mortgages would be assigned to risk weight categories ranging from 35 percent to 100 percent based on the associated LTV. Category 2 mortgages would be considered riskier exposures, such as interest-only, balloon, or negative amortization mortgages. Category 2 mortgages would be assigned risk weights ranging from 100 percent to 200 percent based on the LTV.

The agencies recognize that certain types of residential mortgages, such as interest-only and balloon mortgages, are important products for community banking organizations. As a result, the agencies are seeking input regarding how to adequately reflect the risks of such exposures.

-

How do I submit a comment letter to the Federal Reserve Board? The Federal Reserve Board has extended the comment period to October 22, 2012. You may submit comments by any of the following methods:

- Agency website: http://www.federalreserve.gov

. Follow the instructions for submitting comments at http://www.federalreserve.gov/apps/foia/proposedregs.aspx

. Follow the instructions for submitting comments at http://www.federalreserve.gov/apps/foia/proposedregs.aspx  .

. - Federal eRulemaking Portal: www.regulations.gov. Follow the instructions for submitting comments.

- E-mail: regs.comments@federalreserve.gov. Include docket number R-1442 in the subject line of the message.

- Fax: (202) 452-3819 or (202) 452-3102.

- Mail: Jennifer J. Johnson, Secretary, Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue, N.W., Washington, D.C. 20551.

- Agency website: http://www.federalreserve.gov

All public comments are available on the Board’s website at http://www.federalreserve.gov/apps/foia/proposedregs.aspx ![]() as submitted, unless modified for technical reasons.

as submitted, unless modified for technical reasons.