Slowing Agricultural Markets Highlight the Importance of Sound Risk Management Principles *

by Tara L. Humston, Senior Vice President, Division of Supervision and Risk Management, Federal Reserve Bank of Kansas City *

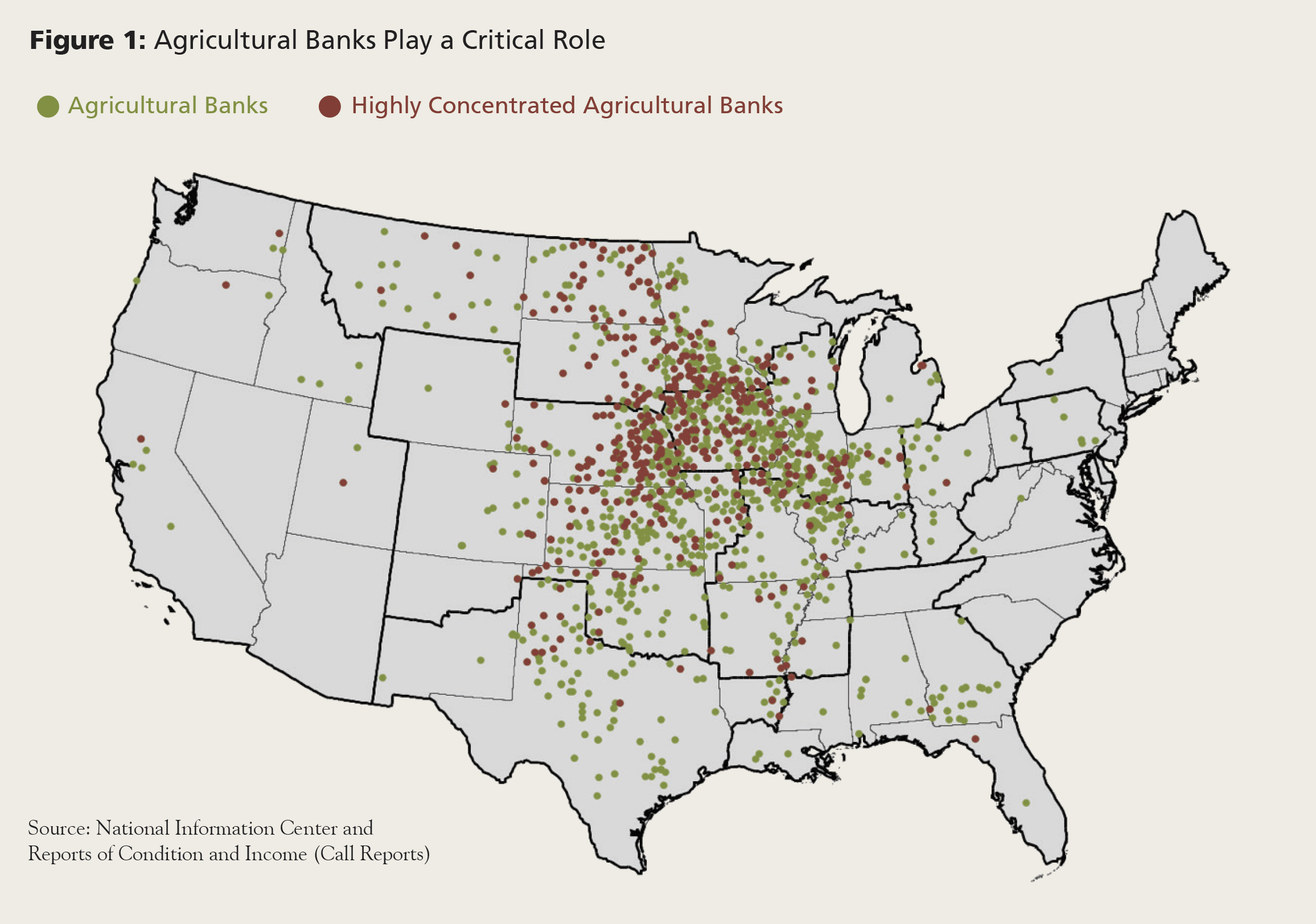

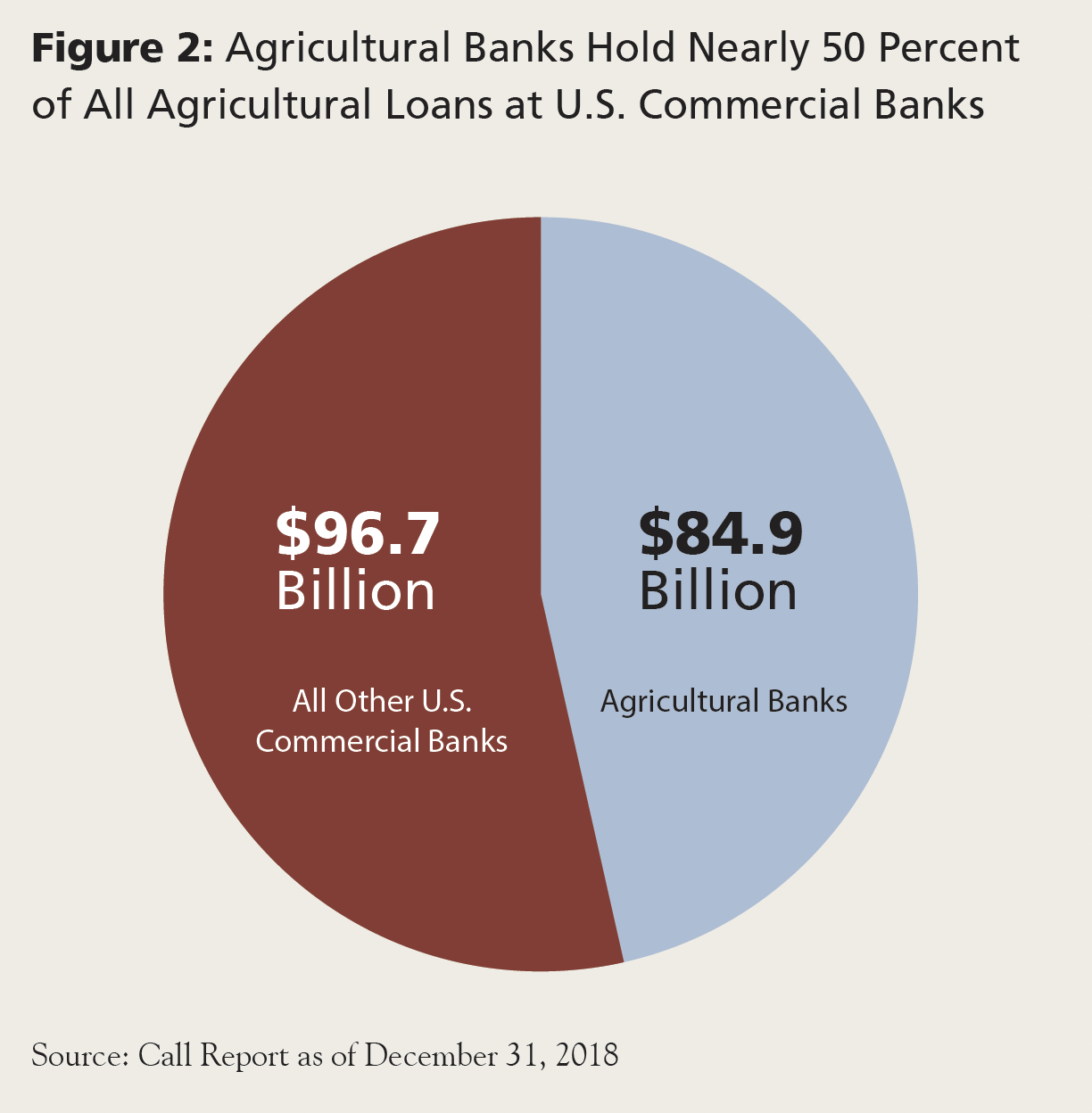

After serving in various leadership positions throughout the supervision function at the Federal Reserve Bank of Kansas City, I recently succeeded Senior Vice President Kevin Moore, who retired from the Federal Reserve Bank of Kansas City after 37 years of service. Throughout my career, Kevin often mentored me and shared important lessons learned from his time starting as a bank examiner during the height of the farm crisis in the 1980s, which resulted in more than 200 agricultural banks failing from 1984 to 1987.1 He is well known to many as a supervisor who had seen it all and viewed experience and judgment as critical success factors in banking. He also shared stories of how growing up in the rural community of Harlan, IA, with a population of 4,900, gave him the opportunity to see firsthand just how critical agricultural banks are in providing local farmers and other commodity producers with access to credit. Today, agricultural banks remain just as vital in providing credit to these farm and ranch communities, as illustrated in Figure 1, which shows the large concentration of agricultural banks2 in the Midwest and other more rural parts of the U.S. In aggregate, agricultural banks actually hold almost half of all agricultural loans at U.S. commercial banks (Figure 2).

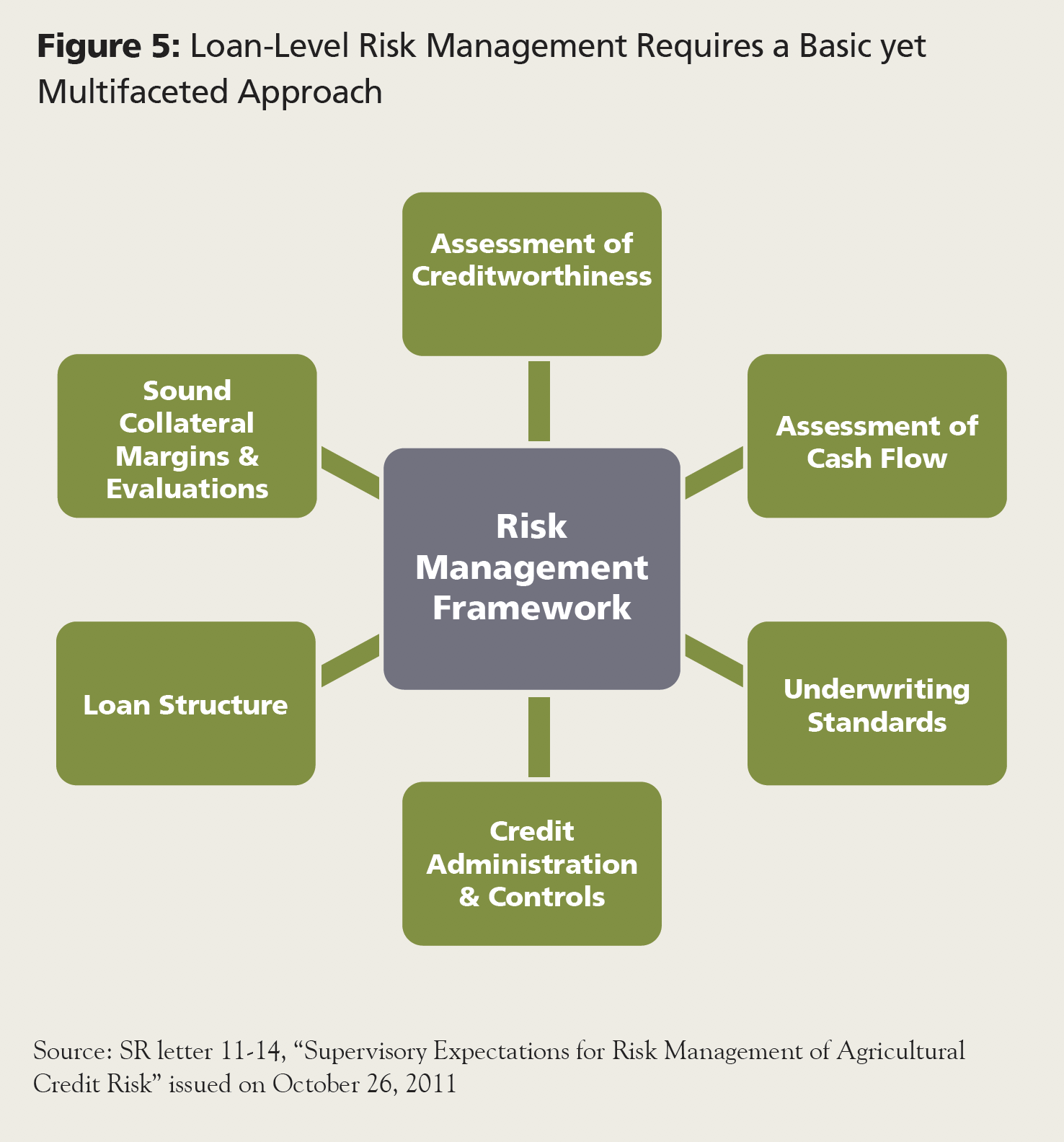

My purpose in referencing Kevin’s experiences and counsel is not that I think a turn to a 1980s-style crisis is imminent. Banking conditions are good today compared with those of the 1980s, with higher capital levels, sound earnings performance, and overall satisfactory asset quality indicators. Risk management practices also have evolved and improved. Nevertheless, we are mindful to not forget the lessons of the past in our oversight of a large portfolio of community and agricultural banks in the Tenth District, especially those institutions that report a higher level of credit concentration risk. Against this backdrop, this article recaps the lessons learned from the 1980s relative to today’s challenging agricultural outlook; highlights the importance of sound underwriting, ongoing monitoring, and credit risk ratings; and outlines several risk management practices, many of which you will find captured in Supervision and Regulation letter 11-14, “Supervisory Expectations for Risk Management of Agricultural Credit Risk.”

Lessons Learned from the 1980s

One key lesson learned from the 1980s is that proactive risk management practices could lessen the damage that small communities can experience as the result of a downturn. Significant risk management mistakes made in the 1980s resulted in severe financial stress at agricultural banks. For example, problem loans surfaced quickly at banks that made credit decisions based on collateral value rather than cash flow analysis. Moreover, inadequate board of directors oversight, including reactive capital and liquidity strategies, was common at banks that eventually failed. These risk management issues were exacerbated at agricultural banks with larger credit concentrations.

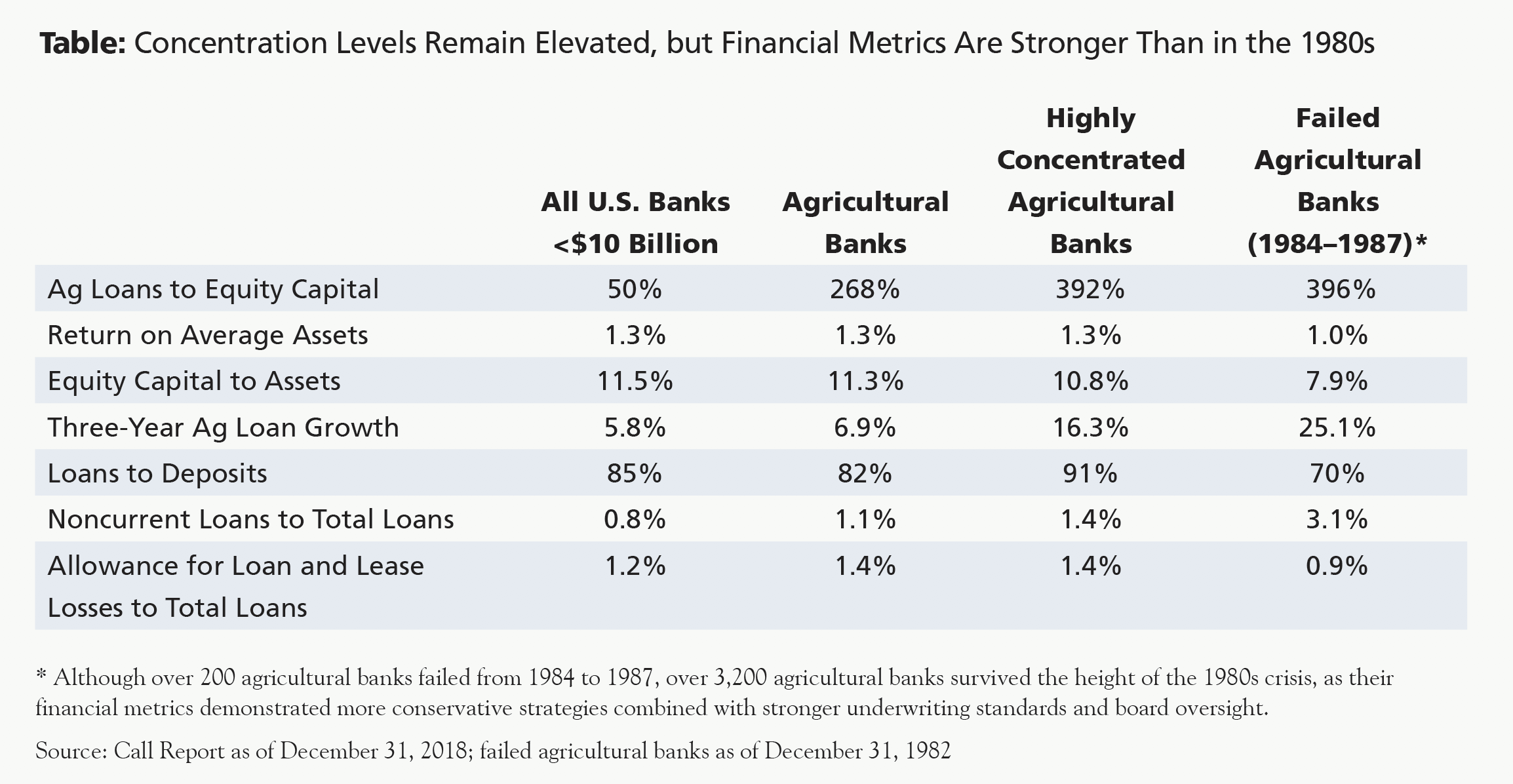

The table provides current key financial ratios for all U.S. banks under $10 billion, agricultural banks, and highly concentrated agricultural banks, as well as comparative ratios from December 1982 for those agricultural banks that eventually failed from 1984 to 1987. Keep in mind the table does not reflect the quality of risk management functions and is solely focused on the financial data. The agricultural banks that failed reported lower capital levels that were not commensurate with the increasing layering of risks, including large credit concentrations, rapid loan growth, rising nonperforming loans, and a low reserve level. These agricultural banks had very little financial cushion to handle a market downturn or borrowers experiencing financial stress.

What’s Different Today?

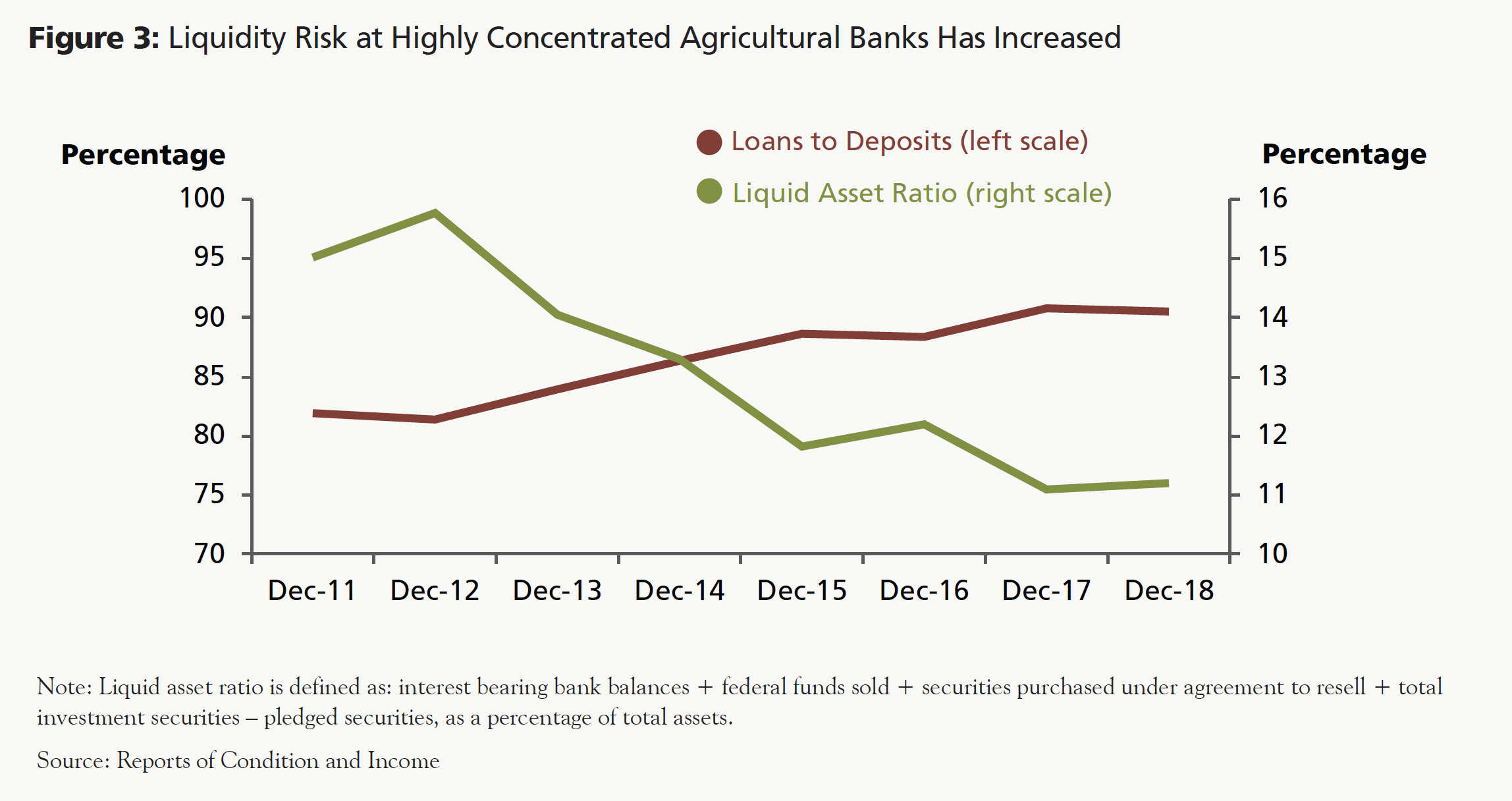

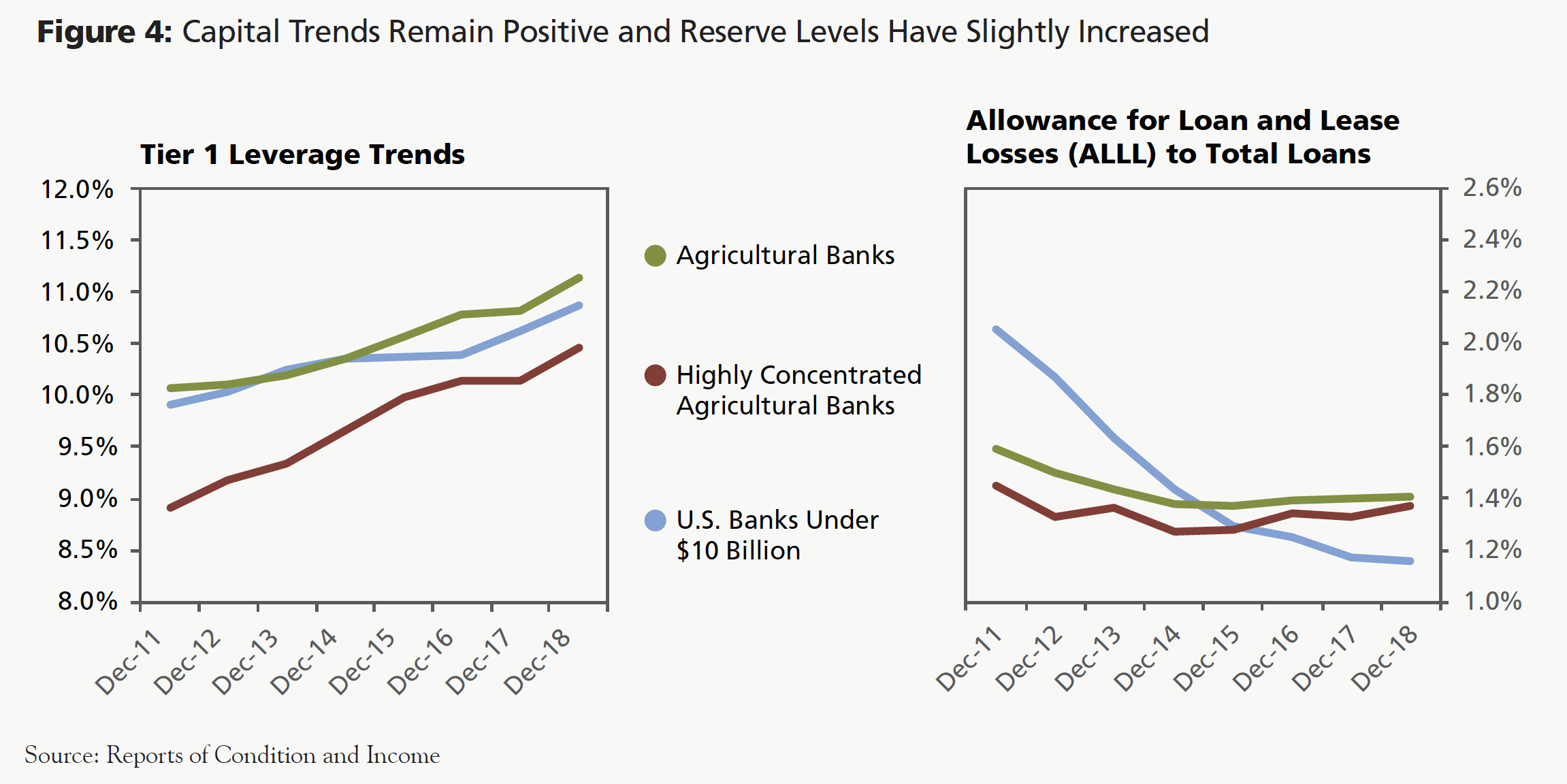

While the current prolonged and gradual declines in farm net income since 2013 have led to greater borrowing needs, and highly concentrated agricultural banks are reporting increasing loan-to-deposit ratios and smaller liquid asset cushions (Figure 3), it is reassuring to recognize that agricultural banks today report stronger aggregate financial metrics and ratios. Highly concentrated agricultural banks today report in aggregate approximately 37 percent more capital and 56 percent more in reserves than those agricultural banks that eventually failed from 1984 to 1987. Moreover, agricultural banks report an increasing and positive trend in capital levels and a steady increase in reserve levels since 2011 (Figure 4), despite the downturn in agricultural conditions. In addition, it has been noted during examinations that underwriting standards have remained conservative, with agricultural bankers often requiring larger down payments or additional collateral requirements and performing extensive analyses to determine whether a borrower could generate sufficient cash flow to meet loan payments.

Furthermore, agricultural lending continues to rely on relationship banking, and most agricultural lenders have in-depth knowledge of and experience in their local and regional markets to make well-informed credit decisions. Learning from their experiences in the 1980s, agricultural lenders now perform extensive and global cash flow analyses to determine whether borrowers can generate enough cash flow to make loan payments, require protective loan covenants, and use more sophisticated automated software packages that can provide for a sensitivity analysis or stress test on an individual loan basis. Furthermore, it has been noted that agricultural lenders are reluctant to permit farmers to use the rising value of their farmland to increase their borrowing power. As land values skyrocketed in the earlier part of this decade, agricultural lenders required larger down payments on new farm real estate loans, set caps on the amount they were willing to lend per acre, and used more historical values for underwriting. Many agricultural lenders now use credit enhancements such as loan guarantee programs through the U.S. Department of Agriculture’s Farm Service Agency to appropriately structure weaker borrowers and reduce overall credit risk. Building upon these positive developments in underwriting at agricultural banks, agricultural lenders should continue to adhere to prudent underwriting and monitoring of creditworthy borrowers, particularly in light of declines in overall agricultural market conditions (Figure 5).

Basic Credit Principles Remain Relevant

In properly underwriting new or existing credit, it is important that credit memorandums clearly articulate basic borrower and loan information, such as identification of the borrower, the purpose of the loan, analysis of carryover debt, terms of repayment, and alternative sources of repayment. The basic credit principle of “cash is king” remains essential. A borrower’s working capital provides a greater cushion for unexpected events and costs, and also places a borrower in a position to launch a new initiative even in challenging times. Proper loan structure is also a key principle and can help agricultural lenders and borrowers maneuver through various obstacles. Furthermore, the growing credit needs for many agricultural borrowers underscore the importance of requiring borrowers to provide timely and accurate financial information, also a key underwriting principle. This not only helps lenders to monitor the loan but also helps borrowers to manage their businesses. The collateral inspection process has also proven to be an important tool that adds integrity to financial reporting, particularly for a riskier lending area such as cattle feeding. An agricultural bank’s consistent and well-documented inspection process helps both the agricultural lender and the borrower assess whether the credit is being used efficiently.

In addition to sound underwriting and ongoing monitoring of borrowers’ financial reports, agricultural lenders should be familiar with borrowers’ annual marketing plans. Marketing plans are created to organize, direct, and handle upcoming agricultural projects, including the ability to identify the best potential markets and find the most effective and efficient means of bringing products to market. In an environment of lower and more volatile commodity prices, agricultural lenders need to understand the importance of a borrower’s ability to execute a strong marketing plan. Many financially stressed borrowers have a poor marketing plan or fail to execute a sound marketing plan. Many agricultural lenders have indicated that the strongest borrowers review their marketing plans weekly or daily to know when and how to capture sales to cover their breakeven expenses plus a profit.

Accurate Credit Risk Ratings Are Essential

Well-managed credit risk rating systems promote informed decision-making, measure credit risk, and differentiate individual credits by the risk they pose. Agricultural banks should realistically and accurately rate the risk of loans and document any workout plans. It has been noted that many agricultural borrowers have restructured debt to adjust to tighter margins and provide working capital. Although the continued strength of farm real estate values has likely shielded many agricultural banks from a higher level of adversely classified loans, merely having land equity does not preclude adverse classification. The key underwriting principle is that the payback period selected should depend upon the useful economic life of the available collateral and on realistic projections of the operation’s payment capacity. With a restructured note, a risk rating downgrade may be appropriate; however, a borrower performing according to the agreed-upon plan may also warrant an upgrade or pass designation. Overall, there are no hard and fast rules examiners use to adversely classify agricultural loans, including those borrowers with carryover debt. They carefully examine all relevant facts to ensure an accurate risk rating.

Prudent Risk Management Practices Are Expected Regardless of Market Conditions

Despite the severe problems many agricultural banks experienced in the 1980s, one of the many lessons learned is that most agricultural banks did not fail. In fact, studies3 of bank failures in the 1980s indicate agricultural banks that pursued more conservative lending, liquidity, and capital strategies and applied proactive risk management practices eventually recovered and survived. Although adopting these practices does not necessarily provide immunity to similar downturns, agricultural banks that incorporate prudent risk management principles and sound underwriting are better positioned to weather business cycle fluctuations or unforeseen credit problems. The current supervisory response has been to raise awareness of lessons learned from past downturns through outreach efforts (see Resources box) and ongoing supervisory activities. Based upon my experiences and stories shared with me, the key message is to be proactive and focus on building capital and liquidity levels while enhancing risk management practices. We should strengthen and follow these practices before the farm economy weakens any further or agricultural borrowers’ financials show more signs of pronounced risk.

- * The author thanks Assistant Vice President Nick Hatz of the Federal Reserve Bank of Kansas City’s Omaha Branch for his contributions to this article.

- 1 See www.fdic.gov/bank/individual/failed/banklist.html.

- 2 Supervisors have defined an agricultural bank as a bank with combined agricultural production and farmland loans accounting for 25 percent or more of total loans. About one-third of those agricultural banks are considered “highly concentrated,” meaning total agricultural lending is more than 300 percent of their total risk-based capital.

- 3 See www.fdic.gov/bank/historical/history/.