Serving Small Businesses in a Crisis: The Role of Community Banks During the COVID-19 Pandemic

by Steve Jenkins, Senior Vice President, Supervision & Regulation, Credit Risk Management & Statistics, Federal Reserve Bank of Cleveland

The COVID-19 pandemic continues to have unprecedented effects on economic activity around the world. In attempts to curb the spread of the disease, many state and local governments imposed stay-at-home or shelter-in-place orders that continue to impact the operations and viability of small businesses around the country. Estimates based on the Census Bureau’s Current Population Survey (CPS) indicate that the number of active business owners in the United States plummeted from 15.0 million in February 2020 to 11.7 million in April 2020 and only partially rebounded by June 2020.1 Moreover, a JPMorgan Chase & Co. survey of 2,500 small business owners found that these businesses, on average, saw their sales drop 29 percent over the second and third quarters of 2020.2

The Federal Reserve Bank of Cleveland has played a leading role in understanding the needs of small businesses and connecting small businesses to resources through its FedTalk series3 and COVID-19 web page4 and has conducted interviews to inform small businesses of loan facilities such as the Main Street Lending Program. In this article, we examine the financial challenges that COVID-19 imposed on small businesses and the role that community banks have played in helping businesses respond to those challenges through the lens of the Federal Reserve’s Small Business Credit Survey (SBCS).5

About the Small Business Credit Survey

The SBCS is an annual survey of firms with fewer than 500 employees. These types of firms represent 99.8 percent of all employer establishments in the United States.6 Survey respondents are asked to report information about their business performance, financing needs and choices, and borrowing experiences. The latest survey was fielded in September and October of 2020, approximately six months after the onset of the pandemic, and the results were published in February 2021. We surveyed more than 15,000 small businesses and gained key insights into how small businesses were impacted by and responded to the pandemic, including financing decisions and challenges. Data are reported by race and ethnicity of the business owner, business size, industry, and financial institution type, allowing for more granular insights into affected business segments and financial institution responses.

COVID-19 and Small Businesses

Not surprisingly, small businesses were hit hard during 2020. Of the SBCS respondents, 57 percent reported that their financial condition was fair or poor (see Figure 1). That percentage is even higher for minority small business owners (see Figure 2), with 79 percent, 77 percent, and 66 percent of non-Hispanic Asian, non-Hispanic Black or African American, and Hispanic business owners, respectively, reporting that their firms’ financial condition was either fair or poor at the time of the survey.

Figure 1: Financial Condition, at Time of Survey (% of employer firms)

Note: Percentages may not sum to 100 due to rounding.

Source: Small Business Credit Survey: 2021 Report on Employer Firms

Figure 2: Share of Firms in Fair or Poor Financial Condition, at Time of Survey (% of employer firms)

Note: The characteristics shown in darker bars are related to self-reported financial condition at a significance level of 0.05 using a logistic regression. The reference group is non-Hispanic White-owned firms.

Source: Small Business Credit Survey: 2021 Report on Employer Firms

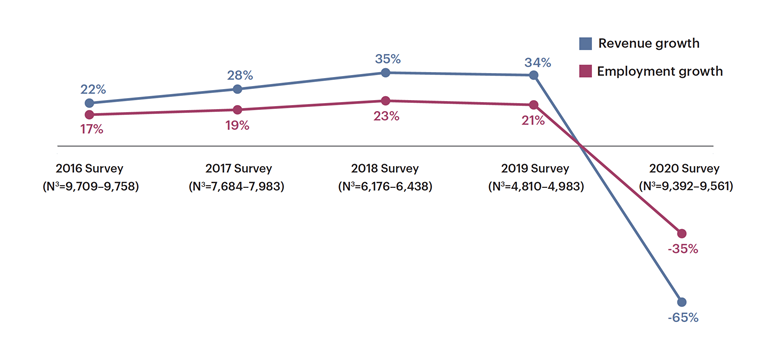

Small businesses suffered deep declines in revenues and many firms reduced the number of employees. According to the survey, 13 percent of the firms reported a revenue increase in 2020, and 78 percent a revenue decline; 11 percent reported an employment increase, and 46 percent an employment decline. For the first time in five years, more firms expected revenue and employment to decline, rather than increase (see Figure 3).

Figure 3: Employer Firm Performance Index, Prior 12 Months

Notes: The index is the share of employer firms reporting growth minus the share reporting a reduction. The 12-month period is approximately the second half of the prior year through the second half of the surveyed year.

Source: Small Business Credit Survey: 2021 Report on Employer Firms

Moreover, of the respondents, 81 percent reported a sales decline due to the pandemic, and approximately 53 percent said their full-year 2020 sales would be reduced by more than 25 percent because of the effects of the pandemic. These challenges are not necessarily expected to be short-lived. Seventy percent of the SBCS respondents said it would be mid-2021 or beyond when their firms’ sales returned to 2019 levels, and 30 percent of the firms experiencing below-normal sales said their businesses were either “very unlikely” or “somewhat unlikely” to survive without government assistance until their sales recover.

The challenges facing small businesses throughout the pandemic also had spillover effects on the personal finances of 80 percent of small business owners. Sixty-three percent of business owners reported that they went without a salary, while 51 percent reported that they put personal funds into the business. Given the disparate impact of the pandemic on minority businesses reflected in the survey results, the pandemic likely has had a similarly disparate impact on minority small business owner households.

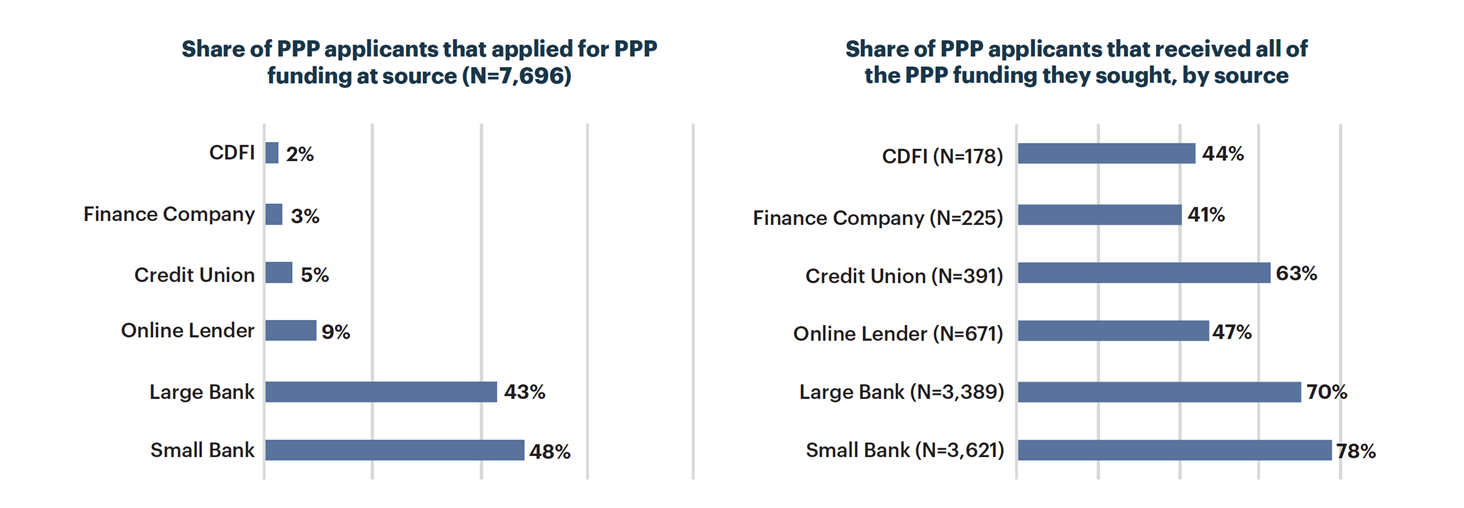

The Community Bank Response

Community banks played a critical role in helping small businesses weather the first six months of the pandemic. According to the survey, 82 percent of small businesses applied for emergency funding through the Small Business Administration’s Paycheck Protection Program (PPP), and community banks were critical in processing and originating those loans. While small banks7 hold only 14 percent of commercial banking sector assets,8 they received the largest portion of total PPP applications, 48 percent, followed by larger commercial banks9 with 43 percent, and online lenders with 9 percent. Community banks also experienced the highest application approval rates, as 78 percent of small bank PPP applicants received all of their requested funding (see Figure 4).

Figure 4: PPP Applications and Outcomes, by Source

Note: Respondents could select multiple options; respondents may have submitted more than one application.

Source: Small Business Credit Survey: 2021 Report on Employer Firms

Fourth District community banks were particularly active in supporting the emergency funding needs of small businesses. As shown in Figure 5, PPP loans accounted for roughly 8 percent of the total loans at Fourth District community banks as of June 30, 2020, compared with 4.5 percent of the total loans at commercial banks nationally. By providing this vital support to small businesses, community banks may ultimately increase their small business lending market share, as anecdotal reports indicate that providing emergency funding support to noncustomers may translate into new permanent lending relationships.10

Figure 5: PPP Loans as a Percent of Total Loans

Source: Consolidated Reports of Condition and Income (Call Reports)

In addition to processing and originating PPP loans, community banks played a critical role in providing other sources of small business credit. According to the survey, small business customers were most likely to apply for a loan, line of credit, or cash advance through a community bank in 2020, a shift from 2019, when small businesses were most likely to apply to large banks for this funding (see Figure 6).

Figure 6: Credit Sources Applied to (% of loan, line of credit, and cash advance applicants)

Notes: Respondents could select multiple options; excludes emergency funding applications.

Source: Small Business Credit Survey: 2021 Report on Employer Firms

Community banks responded with relatively high approval rates on small business applications. As shown in Figure 7, while post-pandemic loan approval rates were below pre-pandemic levels across all financial institutions, community banks exhibited the highest small business loan, line of credit, and cash advance approval rate among financial institutions tracked in the survey.

Figure 7: Approval Rates for Loan, Line of Credit, and Merchant Cash Advance Applications, by Source

Note: Approval rate is the share of approval for at least some credit.

Source: Small Business Credit Survey: 2021 Report on Employer Firms

Fourth District community banks played a critical role in small business financing even prior to the pandemic. Small business loans made up over 4 percent of Fourth District community banks’ assets as of December 31, 2019, twice that of U.S. commercial banks nationally (see Figure 8). Since the crisis, the small business loan share of Fourth District community bank assets has increased sharply, driven in part by PPP loans.

Figure 8: Small Business Loans as a Percent of Total Assets

Note: Small business loans are defined as commercial and industrial loans

less than $1 million.

Source: Consolidated Reports of Condition and Income (Call Reports)

Finally, survey results reveal that the small businesses that were approved for at least some of the financing sought from community banks were generally satisfied with the service they received, with 81 percent of those small businesses reporting satisfaction, up from 79 percent in 2019. In contrast, the satisfaction rate for the small businesses that were approved for at least some of the financing sought from large banks was only 68 percent.

Future Small Business Credit Needs

The SBCS reveals that all businesses continue to face headwinds. According to the survey, 95 percent of the firms expected pandemic-related challenges to continue into the next 12 months; of those, 32 percent expect to face challenges with regard to credit availability (see Figure 9).

Figure 9: Challenges Firms Expect to Face as a Result of the Pandemic, Next 12 Months

Note: Respondents could select multiple options.

Source: Small Business Credit Survey: 2021 Report on Employer Firms

While weak demand remains the top concern for small businesses in the survey (see Figure 10), credit availability is the top concern for non-Hispanic Black– or African American–owned small businesses, and that concern is likely driven by the relatively low levels of funding received by these small business owners. As shown in Figure 11, only 13 percent of non-Hispanic Black– or African American–owned small businesses received all financing sought, compared with 40 percent of non-Hispanic White businesses.

Figure 10: Single Most Important Challenge Firms Expect to Face as a Result of the Pandemic, Next 12 Months, Top Challenges Shown

Source: Small Business Credit Survey: 2021 Report on Employer Firms

Figure 11: Share of Firms That Received All Financing They Sought (% of applicants)

Source: Small Business Credit Survey: 2021 Report on Employer Firms

Conclusions

Small businesses play a significant role in United States job creation. The Small Business Administration’s most recent Small Business Profiles show small businesses added 1.8 million net new jobs in the United States during 2019, the latest year studied.11 According to the SBA profile, the United States has 30.7 million small businesses, and they employ 47.3 percent of the private workforce, and small businesses drive job creation.

As a result of the COVID-19 pandemic, small businesses experienced dramatic declines in both revenues and employment, and many business owners sacrificed personal assets to help their firms survive these unprecedented times. During the first six months of the pandemic, community banks played a central role in helping this important economic segment access government-provided emergency funding, as well as in providing private loans, lines of credit, and cash advances. Community banks received and approved more small business loan, line of credit, and cash advance applications than did their large bank counterparts.

Small business owners continue to face headwinds, however, and Black-owned small businesses report that credit availability remains a top concern. Serving this important segment and ensuring the ability of small businesses, particularly minority-owned small businesses, to equitably access credit will remain an important challenge for community banks and all financial institutions.

- 1 R. Fairlie, “The Impact of COVID-19 on Small Business Owners: Evidence from the First Three Months After Widespread Social-Distancing Restrictions,” Journal of Economics and Management Strategy, 29(4) (2020), pp. 727–740.

- 2 D. Farrell, C. Wheat, and C. Mac, Small Business Financial Outcomes During the Onset of COVID-19, JPMorgan Chase & Co., Institute Report, June 2020, available at www.jpmorganchase.com/institute/research/small-business/small-business-financial-outcomes-during-the-onset-of-covid-19.

- 3 The series is available at www.clevelandfed.org/newsroom-and-events/events/fedtalk.aspx.

- 4 The web page is available at www.clevelandfed.org/en/newsroom-and-events/covid-19.aspx.

- 5 C. K. Mills, J. Battisto, M. de Zeeuw, S. Lieberman, and A. M. Wiersch, Small Business Credit Survey: 2021 Report on Employer Firms, Federal Reserve Banks, 2021, available at www.fedsmallbusiness.org/medialibrary/FedSmallBusiness/files/2021/2021-sbcs-employer-firms-report.

- 6 Mills et al., Small Business Credit Survey: 2021 Report on Employer Firms.

- 7 Small banks are defined as banks with less than $10 billion in total assets.

- 8 The percentage is according to Consolidated Reports of Condition and Income (Call Reports) as of December 31, 2020.

- 9 Larger commercial banks are defined as banks with greater than $10 billion in total assets.

- 10 See Susan Orr, “Banks Use PPP Loans to Find New Customers, Offer Other Services,” Indianapolis Business Journal, April 30, 2021, available at www.ibj.com/articles/alluring-appetizer.

- 11 The 2019 Small Business Profile is available at https://cdn.advocacy.sba.gov/wp-content/uploads/2019/04/23142719/2019-Small-Business-Profiles-US.pdf .