New Rules on Accounting for Credit Losses Coming Soon

by Christopher Hahne, Risk Analytics and Surveillance Manager, and William Lenney, Regulatory Applications Specialist, Federal Reserve Bank of Philadelphia

The Financial Accounting Standards Board (FASB) is expected to issue the current expected credit loss (CECL) model in the first half of 2016.1 The CECL model, which will apply to all depository institutions without exclusions, is expected to take effect January 2019 for public companies2 and one to two years later for nonpublic entities.

What Changes Are Expected?

With the CECL model, the FASB is striving to remove the probable and incurred criteria under current guidelines and replace them with a lifetime expected credit loss concept. The CECL model will extend the time frame covered by the estimate of credit losses by including forward-looking information, such as “reasonable and supportable” forecasts, in the assessment of the collectability of financial assets. In addition, the CECL model will institute a single credit loss model for all financial assets, both loans and securities, that are carried at amortized cost. This means that the CECL model will change the accounting for the allowance for loan and lease losses (ALLL) associated with held-for-investment loan and lease portfolios, as well as the other-than-temporary impairment (OTTI) of held-to-maturity securities.

Under the CECL model, the allowance will equate to the estimate of losses expected over the life of a financial asset. The allowance will be created upon origination or acquisition of the financial asset and updated at subsequent reporting dates. And since the CECL model eliminates the requirement to defer the recognition of credit losses until it is probable that a loss has occurred, applying this model will result in earlier loss recognition.

The Federal Reserve supports the transition to the CECL model and will work with other domestic supervisors to develop supervisory guidance once the FASB publishes the final rule. The Federal Reserve will not require depository institutions to follow a particular method when implementing the CECL model. As the FASB has noted, depository institutions can use their current methodologies to implement the CECL model; however, lifetime loss data and assumptions will now be required. The FASB has stated, and the Federal Reserve has worked to ensure, that the CECL model will be scalable to the size of a depository institution.

Why Is the Model for Impairment of Financial Assets Changing?

In response to the global economic crisis, various stakeholders, including the Federal Reserve, determined that the approach currently used for measuring impairment of financial assets — the “incurred loss model” — delays the recognition of credit losses and overstates assets. The incurred loss model does not permit a loss to be recognized until it is determined that a loss is both probable and estimable. This model limits the loss estimate to current, objective evidence and ignores future expected events. As a result, incurred loss estimates serve more as a lagging indicator of impairment losses rather than a leading indicator of expected asset performance.

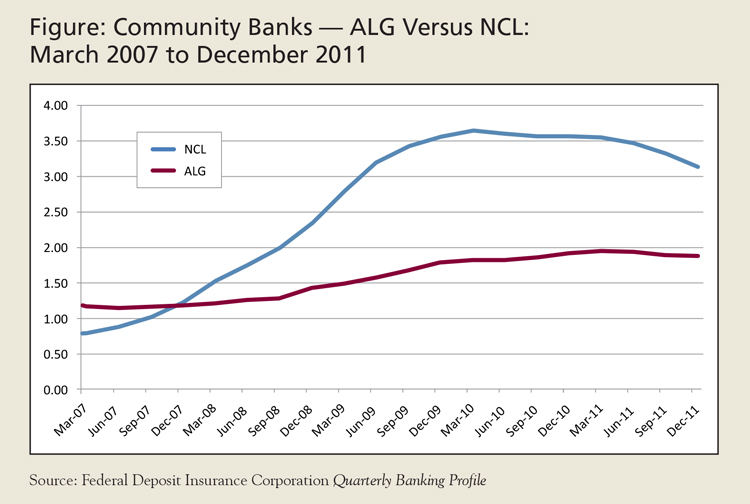

The figure below shows that the ALLL as a percentage of gross loans and leases (ALG) for community banks with assets between $100 million and $1 billion reached a low of 1.15 percent in the second quarter of 2007. At the end of the first quarter of 2008, the ALG was still relatively low, at 1.21 percent, while the noncurrent loans and leases as a percentage of gross loans and leases (NCL) had increased to 1.54 percent. By the first quarter of 2010, however, the NCL had risen dramatically to 3.66 percent, while the ALG did not reach its peak of 1.95 percent until the first quarter of 2011.3 The results were similar for the entire population of insured depository institutions in the U.S. The rapid deterioration in loan quality and the lagging nature of the increase in the ALLL indicated that delayed recognition of credit losses resulted in ALLLs that were inadequate and untimely. The FASB and the International Accounting Standards Board concluded that the accounting standards required changes to eliminate such delays in credit loss recognition.

How Will the CECL Model Impact Community Banks?

Earlier recognition of losses that will result from the implementation of the CECL model will most likely increase ALLLs, although the actual impact to individual depository institutions is dependent on the point in the credit cycle, future expected conditions, and portfolio credit risk attributes. In general, because a longer time horizon for measuring losses will be instituted, some increase is expected for all depository institutions. Thomas J. Curry, Comptroller of the Currency in the Office of the Comptroller of the Currency, believes the CECL model can increase an institution’s ALLL by 30 to 50 percent.1 Further, the extent of the impact for depository institutions could vary widely, as the provision amounts will depend primarily on the credit risk profile of each depository institution.

An increase in a depository institution’s ALLL will result in a decrease in its capital; however, many community banks currently have adequate amounts of capital to absorb the impact of higher reserves. Nonetheless, depository institutions should be proactive in estimating the potential impact to their regulatory capital ratios to assess whether they will have sufficient capital at the time that the CECL model goes into effect. Depository institutions with estimated capital ratios close to prompt correction action (PCA) limits will need to prepare for the implementation of the CECL model to avoid migrating to a lower PCA category.

The FASB expects to issue the final CECL model rule in the first half of 2016, and community banks need to consider the type of data that they will need to make a lifetime loss estimate. The Federal Reserve does intend for the CECL model to be scalable to all depository institutions, regardless of their asset sizes. Nevertheless, many community banks may not have collected and stored the type of information that may be necessary to implement the CECL model. The FASB has provided a longer phase-in period to give nonpublic entities the time to collect the data. Community banks are encouraged to assess their data needs as soon as the final rule is issued, rather than waiting until the rule is implemented.

Finally, the CECL model will utilize certain qualitative and quantitative information used in the current incurred loss model. Unadjusted historical lifetime loss information, vintage data, past events and current conditions, and reasonable and supportable forecasts should still be considered when estimating expected credit losses.

How Can Community Banks Prepare for the CECL Model Implementation?

Since the CECL model has not yet been finalized, depository institutions should visit the FASB website5 to stay current with the FASB’s progress. The website provides updated and detailed information on the proposed accounting standard. Additionally, the Federal Reserve hosted an Ask the Fed session6 concerning the CECL model changes.7 Depository institutions should also discuss the proposed rules with their external auditors, regulators, and industry peers.

Adoption of the CECL model may require taking a more granular approach to the allowance methodology for estimating credit losses. Assistance may be necessary to capture and manage the data needed to accurately calculate an institution’s ALLL. Depository institutions should begin to form multidisciplinary teams to review the rule. Team members should include subject matter experts from credit, information technology, accounting, and financial reporting, all of whom will be important in the implementation of the CECL model. In addition, other business lines should be consulted. For example, a depository institution’s capital expert should assist in assessing the potential impact of the CECL model on the depository institution’s capital level.

In order to transition from today’s incurred loss model to the forward-looking CECL model, depository institutions should determine which methodologies they will utilize in their CECL estimation process and implement a scalable approach to collect the necessary data. Depending on the methodology selected, the financial asset data for the CECL model loan loss calculations may include origination/acquisition date and amount, maturity date, initial and subsequent charge-off dates/amounts, cumulative loss amounts, risk ratings and subsequent changes, risk rating date changes, and other variables. The information requirements and the methodology type will differ by asset portfolio. For example, for commercial loans, a methodology such as a migration analysis could be appropriate to estimate losses under the CECL model. A migration analysis would provide a reflection of the credit quality within each homogeneous pool of loans, resulting in a broader overview of the risk within each loan type and a more detailed loss estimate. This approach, however, is not necessarily the only approach that would comply with the requirements of the CECL model.

Adoption of the CECL model will not be required earlier than January 1, 2019. Therefore, depository institutions should have sufficient time to prepare and collect data before the model is put into practice. Additionally, depository institutions will not be permitted to build up allowance levels in anticipation of the CECL model and must continue using the current incurred loss model until the new model goes into effect. Since internal and external information will be used to estimate expected credit losses, bankers should begin now to prepare for an orderly transition to the CECL model. An institution may need to revise its current methods of collecting data. At present, there are numerous steps that bank management can take to prepare for the implementation of the CECL model:

- Discuss the proposed accounting changes with external auditors, industry peers, and regulators to prepare for the implementation.

- Review current ALLL, OTTI, and credit risk management practices to identify possible synergies with the CECL model.

- Identify the portfolio segmentation needed to implement the proposed CECL model, such as grouping assets with similar risk characteristics. The loan portfolios, whether commercial or retail, should be accounted for at the most granular level possible, as more granular segmentation allows for better loss estimates.

- Consider the type of modeling methodologies that might be appropriate for different loan portfolio types as well as the data requirements for the different methodologies.

- Analyze the depository institution’s loan accounting and servicing systems to determine whether the institution is able to capture the necessary data for the CECL model’s implementation.

- Review credit losses and their correlation to historic economic data, such as rising interest rates, fluctuating real estate values, or other risks.

- Educate the depository institution’s board of directors about the new rule and the institution’s implementation plan for the CECL model.

- Develop a multidisciplinary team with subject matter experts to implement and maintain the CECL model.

Additionally, the Federal Reserve is not requiring depository institutions to engage consulting firms to implement the accounting change. However, while the timeline for implementation has been extended, depository institutions should start gathering additional historical data or, at a minimum, assess the sufficiency of the existing historical data.

The Federal Reserve recognizes that depository institutions will have to expend resources to implement the CECL model. However, the Federal Reserve does not expect depository institutions to create sophisticated models to comply with the new FASB rule, but rather expects institutions to enhance and update their allowance reporting to meet the new CECL model rule.

Robert Kiyosaki, American businessman and financial literacy activist, once said, “The best way to predict the future is to study the past, or prognosticate.” The CECL model will use similar concepts. It combines the study of historical loss experience with reasonable forecasts and should result in more timely recognition and adequate measurement of credit losses. The transition to the CECL model may be challenging, but with proper preparation and coordination among the bankers, accountants, and regulatory authorities, the transition should be orderly.

Back to top

- 1 See Financial Accounting Standards Board, "On the Horizon," available at http://ow.ly/Xna0U.

- 2 The companies that need to comply include publicly traded depository institutions and institutions not publicly traded but subject to the Federal Deposit Insurance Corporation Improvement Act (FDICIA) Part 363 (institutions with total consolidated assets greater than $500 million).

- 3 See the Federal Deposit Insurance Corporation Quarterly Banking Profile, available at http://ow.ly/Xni3d.

- 4 Brian Hasson, "Allowance for Loan Losses: What the CECL Model Requires and an Example of How to Predict the Future," Stratezy, April 16, 2015, available at http://ow.ly/WCrLg.

- 5 See www.fasb.org.

- 6 See www.askthefed.org.

- 7 See the FedPerspectives webinar titled "An Overview of the Current Expected Credit Loss Model (CECL) and Supervisory Expectations," which was held on October 30, 2015, and is available at https://www.stlouisfed.org/perspectives/.